Apr 9, 2024

European Stocks Slip as Rate-Cut Doubts, Inflation Jitters Weigh

, Bloomberg News

(Bloomberg) -- European stocks fell on Tuesday as doubts over how many interest-rate cuts the Federal Reserve could deliver this year and caution before US inflation data curbed risk sentiment.

The Stoxx 600 index was down 0.6% by the close in London, with insurance, construction and industrial sectors down the most. Mining stocks got a boost as iron ore headed for its largest two-day rally in more than two years, with China entering a stronger season for steel demand. Copper is also trading near a 15-month high. Telecom shares outperformed.

The rally in oil and metals is intensifying fears of a commodity-driven inflation resurgence. Economists surveyed by Bloomberg predict Wednesday’s inflation data will show a slight acceleration in annualized CPI, and traders now favor just two Fed rate cuts this year. US 10-year yields were on Monday within a whisker of the psychologically important 4.5% level and near the highest since November.

“With a lot of data and earnings skewed to the latter stages of the week, it’s keeping investors on the sidelines,” said Mark Taylor, a director at UK broker Panmure Gordon. “The lack of participation ahead of tomorrow’s US CPI print attests to just how dependent sentiment has become to inflation trends, even though this isn’t even the Fed’s preferred measure of cost pressures.”

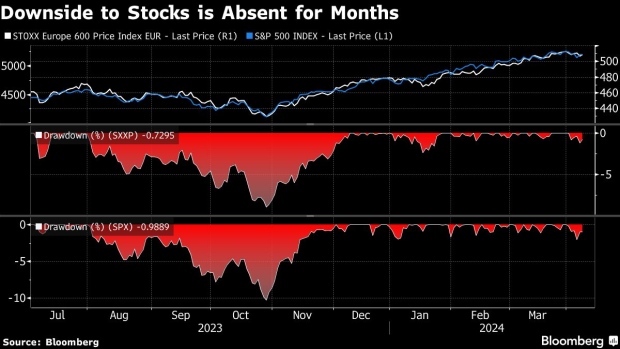

Stocks have been stuck in a tight range over the last month as doubts over the timing and number of rate cuts curbed risk sentiment. Yet, US and European benchmarks are hovering near record levels, with investors expecting further gains, especially in the value sectors which have lagged so far.

Read: European Defense Stocks Sink After Goldman Warns on Valuations

Among individual stock movers, BioMerieux rallied in Paris after its sales for the first quarter rose 6.6%. Embattled French IT company Atos SE slumped as much as 16% as it seeks €600 million ($652 million) in cash and another €600 million in credit lines and loan guarantees to fund the business through 2025.

For more on equity markets:

- Equity Mantra Now Is to Buy Dips But Hedge Risks: Taking Stock

- M&A Watch Europe: Atos, UBS, Gresham Technologies, Telefonica

- Puig Tests EU’s IPO Revival in Tough Madrid Market: ECM Watch

- US Stock Futures Little Changed; Trump Media & Technology Gains

- Grad Gloom: The London Rush

You want more news on this market? Click here for a curated First Word channel of actionable news from Bloomberg and select sources. It can be customized to your preferences by clicking into Actions on the toolbar or hitting the HELP key for assistance. To subscribe to a daily list of European analyst rating changes, click here.

--With assistance from Michael Msika.

©2024 Bloomberg L.P.