(Bloomberg) -- China Evergrande Group attempted to revive confidence in its finances, after fears of a cash crunch sent the property giant’s onshore bonds to record lows and turned its stock into one of the worst performers globally.

In a rare unscheduled exchange statement on Friday night, the world’s most indebted real estate company said its operations were “stable and healthy.” It added that total debt and financing costs had dropped since March and that it hadn’t missed an interest or principal payment since its founding 24 years ago.

Evergrande is battling resurgent concerns about its $120 billion debt pile after reports last week that the company warned Chinese officials of a potential liquidity squeeze and cascade of defaults. Billionaire Hui Ka Yan’s developer has dismissed the reports as based on rumors and “fabricated” documents, yet creditor angst was so extreme on Thursday that several Chinese banks held emergency meetings to assess their exposure.

Read more: Evergrande Faces Crisis of Confidence Over $120 Billion Debt

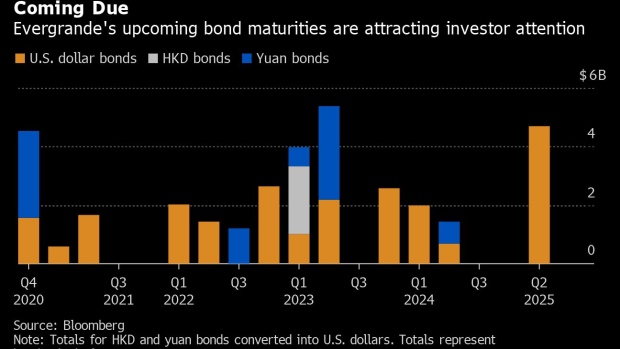

The episode comes at a critical time for Evergrande, which recently launched a nationwide sales promotion and needs to maintain confidence in its creditworthiness if it wants customers to put down large deposits on homes that may take years to complete. The developer will also have to repay about $5.8 billion of bonds and loans over the next two months, raising the prospect of sharply higher refinancing costs if investors balk.

In one positive development announced by Evergrande late Friday, the company won approval from Hong Kong’s stock exchange to spin off its property management unit, paving the way for it to raise much-needed capital. The signoff was reported earlier in the day by Bloomberg.

Investors across Asia are watching Evergrande closely after losses in the company’s offshore notes spread to high-yield debt around the region last week. The developer is not only Asia’s biggest junk bond issuer, it’s also one of the most systemically important companies in China, with 293 million square meters of land reserves and projects in 237 cities as of the end of last year.

The biggest near-term worry surrounding Evergrande relates to an agreement the company struck with some of its largest investors. It gives them the right to demand their money back if Evergrande fails to win regulatory approval for a backdoor listing on the Shenzhen stock exchange by Jan. 31. The repayment could amount to 130 billion yuan ($19 billion), and at least one of the investors has signaled it would be unwilling to extend the deadline.

Evergrande has said it won’t raise new funds through the listing, but the transaction could allow the company to achieve a higher valuation and thus easier access to future financing.

Chinese regulators have yet to comment publicly on Evergrande’s latest troubles, but the government could play a decisive role in the company’s future. Some analysts have speculated Evergrande has failed to get a green light for its listing plan because policy makers are trying to tame sky-high home prices and restrain fundraising by developers. Whether authorities would allow Evergrande to run into serious financial difficulties is now one of the key questions facing creditors, shareholders and customers.

Here are some of the latest analyst views on Evergrande and the Chinese property sector:

Betty Wang and Zhaopeng Xing at Australia & New Zealand Banking Group

The incident poses an event risk to China’s property market in the coming quarters; we cannot exclude the possibility of more developers facing challenges during the process of deleveraging. The government is unlikely to lend a hand to property developers, considering its current stringent stance. However, we don’t think China’s property market will face systemic risks yet, despite the possible bond market stress.

Matthew Chow at S&P Global, which cut its outlook on Evergrande’s B+ credit rating Thursday

We revised the outlooks to negative because Evergrande’s short-term debt has continued to surge, partly due to its active acquisition of property projects. We had previously expected the company to address its short-term debt, especially given the tough economic climate. In addition, we believe Evergrande will have to repay a portion of its sizable A-share strategic investments. This could further weigh on the company’s weaker-than-peer liquidity profile.

Soren Aandahl, founder of short seller Blue Orca Capital

We were not short, but have thought it was a deeply troubled balance sheet for some time. The leverage is just crazy, and not sure any spinoffs or asset sales can fix that problem. In some ways it is surprising that it took so long, but it’s comforting to know that the laws of gravity still apply.

Frank Pan at JPMorgan Chase & Co.

We believe that the market has again overreacted. It would be ironic if the government were pushing developers to deleverage to lower systemic risk and at the same time stopping developers from raising equities which would be a faster way to achieve that. Our base case remains that Evergrande would reach a mutual agreement with the investors should it miss the extended deadline again, leading to another extension. Given the market reaction, we see valuations turning more attractive.

Harsh Agarwal at Deutsche Bank AG

Overall, we do think Evergrande 2021s and 2022s are over-corrected and represent an opportunity to add as a tactical long, and we are staying away from long-dated paper in the China property HY sector due to policy tightening risks.

Manjesh Verma and Stella Li at Citigroup Inc.

We think the company’s recent equity raising and early debt redemption help near-term liquidity, which also helps buying some time to potentially resolve the current situation and potentially rebuild relationship with some existing lenders. Having said that, we think more needs to be done to address the critical situation.

©2020 Bloomberg L.P.