Mar 27, 2022

Fed’s Best Hope Increasingly Looks Like a ‘Semi-Hard’ Landing

, Bloomberg News

(Bloomberg) -- As the Federal Reserve wrestles with bringing down decades-high inflation, perhaps the best economic outcome it can hope for sounds like a contradiction: a growth recession.

That’s a situation where the economy expands more slowly than its roughly 1.5% to 2% long-term trend and unemployment ticks up, but an outright contraction is avoided. While falling short of the picture-perfect soft landing that Fed Chairman Jerome Powell and fellow policy makers envisage, it’s an outcome that economists like Nobel laureate Paul Krugman see as desirable to help ease persistent price pressures.

“If they’re lucky, maybe they’ll get by with a growth recession next year,” said Peter Hooper, a former central bank official who’s now global head of economic research for Deutsche Bank AG. He sees a downturn as more likely than not.

The Fed needs to slow an economy that is “clearly overheated” as it comes out of the pandemic, said Krugman, a City University of New York professor.

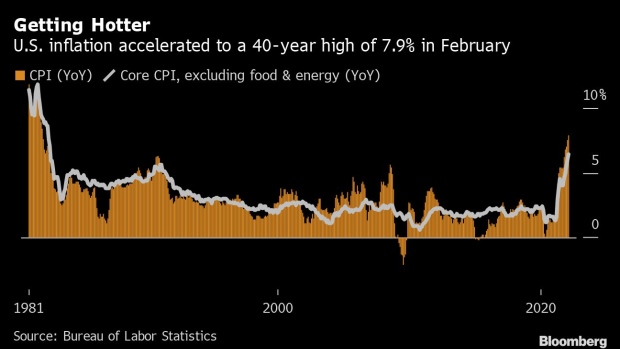

Inflation -- which is already at a 40-year high and more than three times the Fed’s 2% target -- looks set to accelerate again as supply disruptions from the Ukraine war boost food and energy prices. The labor market is, in the words of Powell, “extremely tight,” with 1.7-plus job openings for every unemployed person.

To try to take the edge off demand, the Fed intends to raise interest rates “expeditiously” to more normal levels and is prepared to push them into “restrictive” territory if necessary to achieve price stability, Powell told a conference of economists on March 21.

What Bloomberg Economics Says...

“Fedspeak since the March FOMC meeting has confirmed one thing: The FOMC would have hiked interest rates by 50bps in March had Russia not invaded Ukraine. The war has immediately exacerbated inflation, but the dampening effect on U.S. growth or the labor market has yet to show.”

-- Anna Wong, Yelena Shulyatyeva, Andrew Husby and Eliza Winger (economists)

For the full note, click here

Bond yields shot higher in the wake of Powell’s tough talk as expectations mounted of more rapid tightening by the Fed. The yield on the two-year Treasury note ended around 2.29% on Friday, up sharply from 1.94% a week earlier.

Perhaps not surprisingly, policy makers see themselves pulling off a smooth soft landing of the high-flying economy. Growth slows, but remains above trend, according to their median forecast released on March 16. Unemployment falls to 3.5% from 3.8% now before basically holding steady through 2024. Inflation on the Fed’s favored measure drops to 2.3% by the end of 2024 from 6.1% in January.

Grant Thornton chief economist Diane Swonk said that it’s “fanciful” for the Fed not to expect unemployment to rise as it tightens credit. She forecasts joblessness will increase to 4.8% by the end of next year as the economy slows markedly but avoids a recession.

“I call it a semi-hard landing,” Swonk said.

Krugman told reporters last week that he sees unemployment increasing by about a half percentage point as growth downshifts to an annual pace of around 1%. Gross domestic product expanded 5.7% last year, the most since 1984.

But avoiding an outright contraction is far from a sure thing. A historical study by former Treasury Secretary Lawrence Summers and Harvard University research associate Alex Domash found “a very substantial likelihood of recession” over the next 24 months, given the current configuration of elevated inflation and low unemployment. Summers is a paid contributor to Bloomberg TV.

What’s more, the economy “has always ended up in a full-blown recession” whenever unemployment has risen by more than 0.3 percentage point, former New York Fed President William Dudley, a Bloomberg Opinion columnist, has noted.

“When you’re skating on thin ice, it’s hard not to fall through,” was how Swonk puts it.

Powell has said he doesn’t see an elevated risk of recession in the next year: The labor market is strong and household balance sheets are in good shape.

Many economists agree. For one thing, the economy should benefit in the near term from pent-up outlays on travel and other services as fear of Covid-19 fades, especially among the elderly. A consumer spending index compiled by credit-card company Visa Inc. strengthened in February after sliding in December and January, with growth fastest among consumers over the age of 65.

Households also have a lot of cash socked away and available to spend. At $18.2 trillion, U.S. commercial bank deposits are some $1.8 trillion higher than before the pandemic, thanks in part to stimulus checks and other government support.

But elevated inflation could eat into that seed corn over time and prompt consumers to turn more cautious. Indeed, chain store Macy’s Inc. has already gotten “push back” from customers when it tried to raise prices on lower end sofas and mattresses, Chief Executive Officer Jeff Gennette told analysts on Feb. 22.

As the Fed tightens credit throughout the year, that also will likely take a toll on growth, especially for interest-rate-sensitive sectors like housing.

“While low existing inventory and favorable demographics are supporting demand, the impact of elevated inflation and expected higher interest rates suggests caution for the second half of 2022,” Robert Dietz, chief economist for the National Association of Home Builders, said in a March 16 note after the group reported the third straight monthly decline in builder confidence.

In the end, whether the U.S. falls into a recession may well depend on how far the Fed wants to reduce inflation and how much it thinks it needs to raise interest rates to accomplish that. Krugman foresees a “ferocious debate” next year as core inflation falls to about 3% from 5.2% now and the Fed has to decide whether it’s worth risking a recession to push it down further.

“Should the Fed just declare victory and stop?” Krugman asked. “I’d be inclined to be on the side that would say, ‘Yes.’”

Ethan Harris, head of global economics research at Bank of America Corp., sees the central bank engineering a growth recession next year that brings inflation down to 2.6% and modestly pushes up unemployment.

But he added, “To me that is at the optimistic end of outcomes. The main risks are to the downside.”

©2022 Bloomberg L.P.