May 27, 2021

Ford’s EV-Fueled Rally Still Leaves Stock Miles Behind Tesla

, Bloomberg News

(Bloomberg) -- Ford Motor Co. shares climbed to the highest since October 2015 after the automaker revealed plans to boost its bet on electric vehicles to $30 billion and pledged that 40% of vehicles sold would be battery powered by 2030.

The stock rose as much as 8.3% Thursday, adding to Wednesday’s 8.5% gain and on track for the biggest two-day jump in four months. Ford shares have advanced 68% in 2021.

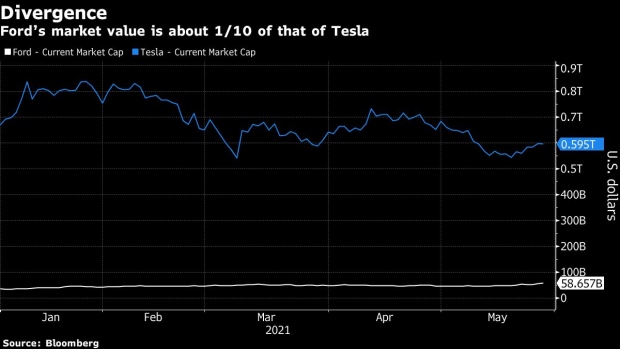

While Ford’s stock has rallied because of its ambitious electric-vehicle plans, it’s still a fraction of the size of EV trailblazer Tesla Inc. In two days, the Dearborn, Michigan-based company added more than $7 billion to its $58.7 billion market value, which is less than 1/10 of Tesla’s $595 billion market capitalization.

“Details of EV strategy, from battery to platforms, and CEO statements like ‘Ford will not cede truck leadership’ should put to rest lingering views that Ford is lagging key peers,” Jefferies analyst Philippe Houchois said after Ford’s Capital Markets Day.

The event spurred RBC Capital Markets to upgrade the stock to outperform from sector perform. Analyst Joseph Spak said he has increased confidence in Ford’s financial targets and the presentation helped alleviate many of his concerns regarding its battery-electric vehicle strategy. Ford has 11 buys, eight holds and two sell ratings, according to data compiled by Bloomberg.

Carmaker peer General Motors Co. has also outlined an ambitious electric-vehicle strategy, planning to sell only zero-emission models by 2035. GM shares have gained 43% this year, lifting its market value to $86.4 billion.

Ford’s rally extended to its suppliers, which broadly rose Thursday. Lear Corp. gained as much as 5% Thursday, Magna International Inc. rose 4.7%, Dana Inc. gained 3.5% and BorgWarner Inc. rose 2.9%.

©2021 Bloomberg L.P.