Jul 25, 2022

Fortunes Start Turning for Asia’s Oil Refiners After Boom Time

, Bloomberg News

(Bloomberg) -- Oil refiners in Asia are starting to mull a reduction in operating rates after running flat out following the blowout in processing margins triggered by Russia’s invasion of Ukraine.

At least three processors in North Asia are considering cutting total run rates from as early as September as profits from turning crude into fuels such as gasoline sank this month, according to company officials, two of which asked not to be identified as the information is private. The third, Formosa Petrochemical Corp., said it has cut gasoline output, and may in turn reduce overall run rates.

The prospect of a dip in refinery usage heading into the final quarter of the year at a time when China has yet to move fully beyond its anti-virus lockdowns may be an additional headwind for crude oil. Benchmark Brent futures are on course in July to cap their first back-to-back monthly loss since late 2020 as recession concerns and tighter monetary policy battered commodities including energy.

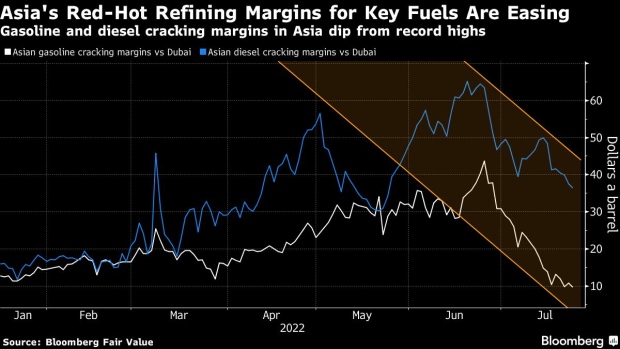

While spot premiums for physical crude cargoes in Asia have climbed this month -- suggesting still-solid demand for now -- margins on products like gasoline have dropped back to levels seen before Russia’s invasion of Ukraine as tightness eased. That’s squeezing refiners’ profits, and may herald a slower pace of operations.

“There may be significant run cuts from September, if the market doesn’t improve,” said Lin Keh-Yen, spokesman at Taiwan’s Formosa Petrochemical. “Crude runs in August are unlikely to change significantly as diesel and low-sulfur fuel oil margins are still good. Moreover, product sales for the month are already done and crude purchases have been made.”

Formosa Petrochemical has already trimmed gasoline output last week by about 5%, and may consider further lowering production of the fuel depending on market conditions, according to Lin.

In Asia, oil traders will start booking October-loading crude cargoes next month, after wrapping up the cycle for September-loading barrels this week.

The weakness in gasoline is set to ripple through other products, according to industry consultant FGE, which warned in a July 22 note of a further decline in overall refinery profits.

Diesel-cracking margins in Asia have also been under pressure. They’ve fallen 40% from their recent peak in late June but remain more than double the level reached before the pandemic in July 2019, according to Bloomberg Fair Value figures. Diesel comprises a majority of the export volumes for Asian refiners.

Further afield there are signs of weakness in gasoline too, including the US, where a run-up in prices to a record during the summer driving season dented usage. In the most recent set of figures, gasoline demand is only just above the same time two years ago on a seasonal four-week rolling average, but below every other year back to 2000, according to the Energy Information Administration.

©2022 Bloomberg L.P.