Jan 27, 2024

FTX Is Unloading Crypto to Raise Cash and Pay Back Customers

, Bloomberg News

(Bloomberg) -- FTX is unloading cryptoassets and hoarding cash as bankruptcy advisers look for a way to repay customers whose accounts have been frozen since the platform collapsed in 2022.

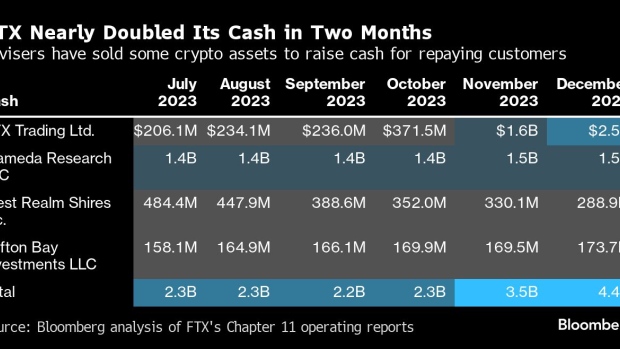

The fraud-tainted crypto firm’s four largest affiliates — including FTX Trading Ltd. and Alameda Research LLC — together nearly doubled the group’s cash pile to $4.4 billion at the end of 2023 from about $2.3 billion in late October, according to Chapter 11 monthly operating reports. The company’s total cash is likely higher including the rest of its affiliates.

A representative for FTX declined to comment.

The company said in a court filing last month that FTX raised $1.8 billion through Dec. 8 by selling off some of the firm’s digital assets. FTX also said it’s conducting Bitcoin derivative trades to hedge exposure to the coin and generate additional yield on its digital holdings — and is exploring options to potentially restart the exchange.

An uptick in FTX’s cash stockpile has coincided with the rising value of customer accounts. Since FTX unraveled in November 2022, bankruptcy advisers have been tracking down assets and struck deals intended to benefit customers who had smaller accounts on the platform. The company has also brought major lawsuits against former associates of Sam Bankman-Fried and crypto firms like Bybit Fintech Ltd. that withdrew funds from FTX before it filed Chapter 11.

Customer claims worth more than $1 million traded at around 73 cents on the dollar as of Friday, up from around 38 cents on the dollar in October, according to investment firm and bankruptcy claims broker Cherokee Acquisition. Actual trading prices depend on the value of a specific claim and other factors, Cherokee Acquisition said.

Even so, FTX has said it doesn’t expect customers will be fully repaid — and that customers of FTX.com will bear a greater percentage of the losses. Dozens of FTX customers are challenging a company proposal that would peg the value of their digital assets at the time the company filed bankruptcy, meaning they’d miss-out on a yearlong Bitcoin rally and rebound for other tokens.

The case is FTX Trading Ltd., 22-11068, US Bankruptcy Court for the District of Delaware.

©2024 Bloomberg L.P.