Feb 25, 2021

Fund That Lost 80% of Assets in GameStop Drama Faces New Turmoil

, Bloomberg News

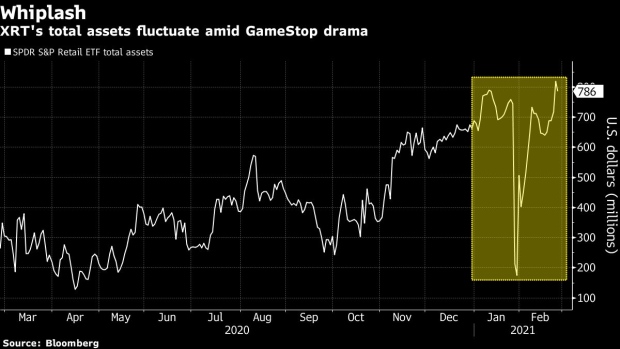

(Bloomberg) -- State Street’s $786 million exchange-traded fund investing in retailers was only just recovering from its last brush with GameStop Corp. Now it’s all happening again.

The SPDR S&P Retail ETF (ticker XRT) is being distorted by the bricks-and-mortar seller of video games for a second time, just a few weeks after losing 80% of its assets in January’s meme-stock drama.

GameStop is on another tear, surging roughly 50% on Thursday after a 104% gain the previous day. That’s a problem for XRT because it’s supposed to hold an equal amount of each stock, but it doesn’t rebalance swiftly enough to counter GameStop’s jump.

The company now makes up about 5.9% of the fund. It should be more like 1%.

Last time around, GameStop’s weighting eventually ballooned to 20% of XRT, prompting an exodus from the fund. It took about three weeks for assets to recover -- they hit the highest level since 2018 on Tuesday, just before the latest bout of meme-stock madness.

With GameStop’s sudden revival, there could be more pain ahead of the passive fund’s March rebalance, according to CFRA Research’s Todd Rosenbluth.

“Investors in XRT have seen this movie before, with GameStop quickly dominating the normally equally weighted portfolio before falling sharply,” said Rosenbluth, CFRA’s director of ETF research. “With no limits on position sizes and the rebalance nearly a month away, the risk is high that the stock will drive performance up and down. Some may not want to stick around to see if the sequel is any better.”

Of course, GameStop’s rally in January was on a different scale -- it soared 1,600%, powering XRT to monthly gains of about 37%. That was a record for the normally staid ETF. But when the retailer plunged, the ETF was hit, and XRT remains around 5% lower in February despite a boost from GameStop this week.

Such whiplash may dim XRT’s appeal as a portfolio hedging tool, according to Citigroup Inc.’s Scott Chronert.

“When you have a stock-specific circumstance like this one, it might mess up how the hedging aspect is working,” Chronert said in an interview earlier this month. “If you’re looking to hedge a long book of retail or consumer names, the weighting impact on the broader sector ETF might not be a very good hedge because it’s dominated by a single name.”

©2021 Bloomberg L.P.