Jul 19, 2023

Funds Tracking UK’s Bluechip Stock Index Have an ESG Problem

, Bloomberg News

(Bloomberg) -- Funds tracking the UK’s main stock index are exposed to considerably more environmental and social harm than those following other major benchmarks in Western Europe.

That’s according to a Bloomberg News analysis of figures compiled by Impact Cubed, a London-based ESG data provider. Exchange-traded funds closely tracking the FTSE 100 are more than twice as exposed to greenhouse gas emissions as ETFs tied to Germany’s DAX, the data show. The ratio rises to more than three for Europe’s benchmark Stoxx 600 and almost 12 when held up against the OMX in Sweden.

Once a powerful symbol of Britain’s free-market economy, the London Stock Exchange is instead becoming an emblem of the country’s failure to keep pace with the US and the European Union in commercializing green technology and innovation. For some ESG investors, that’s making the UK less appealing than many other markets as they hunt for stocks set to outperform in an age shaped by climate change and artificial intelligence.

“The FTSE 100 is a legacy index” filled with old-world stocks, according to James Penny, a veteran ESG investor and chief investment officer at TAM Asset Management in London.

Read More: Why UK’s Once-Vibrant Stock Market Is In the Doldrums: QuickTake

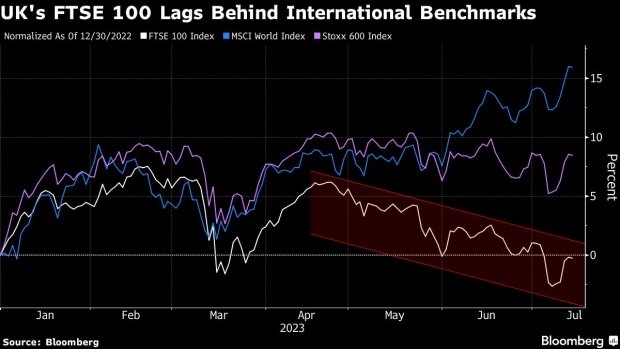

That “legacy” status has coincided with real underperformance. This year’s stagnation in the UK’s main benchmark for stocks compares with gains of around 9% in Europe’s Stoxx 600 Index and 17% in the MSCI World Index.

An analysis of ETFs and the benchmarks they track using the Impact Cubed data shows that exposure to fossil fuels makes up more than 20% of the FTSE 100, compared with less than 3% of the DAX and under 2% of the OMX in Sweden. For Europe’s Stoxx 600 Index, the ratio is just over 10%.

The FTSE 100 also is considerably worse, on average, than its European peers when it comes to exposure to things such as hazardous waste. And companies in the UK benchmark are more likely to tolerate a huge pay gap between chief executive officers and regular staff. Those earning the most in FTSE 100 companies make an average of 87.5 times the median annual total pay of the rest of their company’s employees, the data show.

Laura Hoy, an ESG analyst at Hargreaves Lansdown, says investors will use this earnings season to scrutinize the FTSE 100’s “sin stocks,” whose commitment to ESG — or lack thereof — “will be on full display,” she said in an email.

Shell Plc will be “under the microscope” amid reports it’s planning to retreat from its renewables business, Hoy said. Others facing ESG investor scrutiny include Rio Tinto Plc and British American Tobacco Plc, she said.

An analysis by Impact Cubed shows that funds tracking the FTSE 100 would need to make significant adjustments to the index’s weightings to improve their ESG credentials. That includes slashing Shell’s weighting to about 3% from its current level of roughly 8%.

For some investors, the FTSE 100’s status as a laggard on a number of key environmental, social and good governance metrics has proved unacceptable. Earlier this year, the Oxfordshire branch of the Local Government Pension Scheme, which is overseen by the Pension Fund Committee, said it decided to reduce its allocation to the UK market.

The move was designed “in particular” to cut exposure “to the FTSE 100 companies that have links to major oil, gas and mining,” the group said.

Shell’s recent strategy pivot to downplay its focus on renewables and ratchet up spending on fossil fuels has angered ESG investors. Some, including the Church of England Pensions Board, have responded by blacklisting the company altogether.

Jean-Philippe Hechel, senior portfolio manager at Bank J. Safra Sarasin’s Sustainable Asset Management, owns shares in just one UK listed company — telecommunications carrier Vodafone Group Plc — in the dividend fund he runs.

“I’m very conscious in terms of the climate profile of the mining companies,” said Zurich-based Hechel. “So for the moment we have no exposure there.”

Britain is taking some steps to address concerns that it’s falling behind. London Stock Exchange Group Plc’s FTSE Russell unit earlier this year launched a new index series, which includes an ESG adjusted variant of the flagship FTSE 100 gauge, among others.

“The UK has a phenomenal track record of innovation,” TAM’s Penny said. “Some of the most widely used disruptive ideas across our entire planet’s history came from the UK.”

“We’re still that innovative country,” but “we lack the architecture to bring it to market,” he said.

--With assistance from Greg Ritchie.

(Adds breakdown of CO2 emissions across ETFs in chart.)

©2023 Bloomberg L.P.