Oct 30, 2019

GE jumps as new boost to cash-flow outlook bolsters turnaround

, Bloomberg News

General Electric Co. raised its 2019 cash-flow forecast for the second consecutive quarter, giving Chief Executive Officer Larry Culp’s turnaround effort a much-needed boost. The shares climbed.

- The manufacturing businesses will generate as much as $2 billion in free cash this year, GE said in a statement Wednesday as it reported third-quarter earnings. The company had previously projected no more than $1 billion. Additional coverage.

Key Insights

- The revised forecast, with a midpoint above Wall Street’s expectation, offers a measure of relief on one of the thorniest issues facing the Boston-based company. Investors have braced for weak cash flow this year while looking for signs of a promised rebound beginning in 2020.

- The report may quiet lingering questions after financial investigator Harry Markopolos accused GE of accounting fraud in August. Markopolos has largely retreated from the public eye since alleging GE’s financial state was worse than widely appreciated, claims the company has denied.

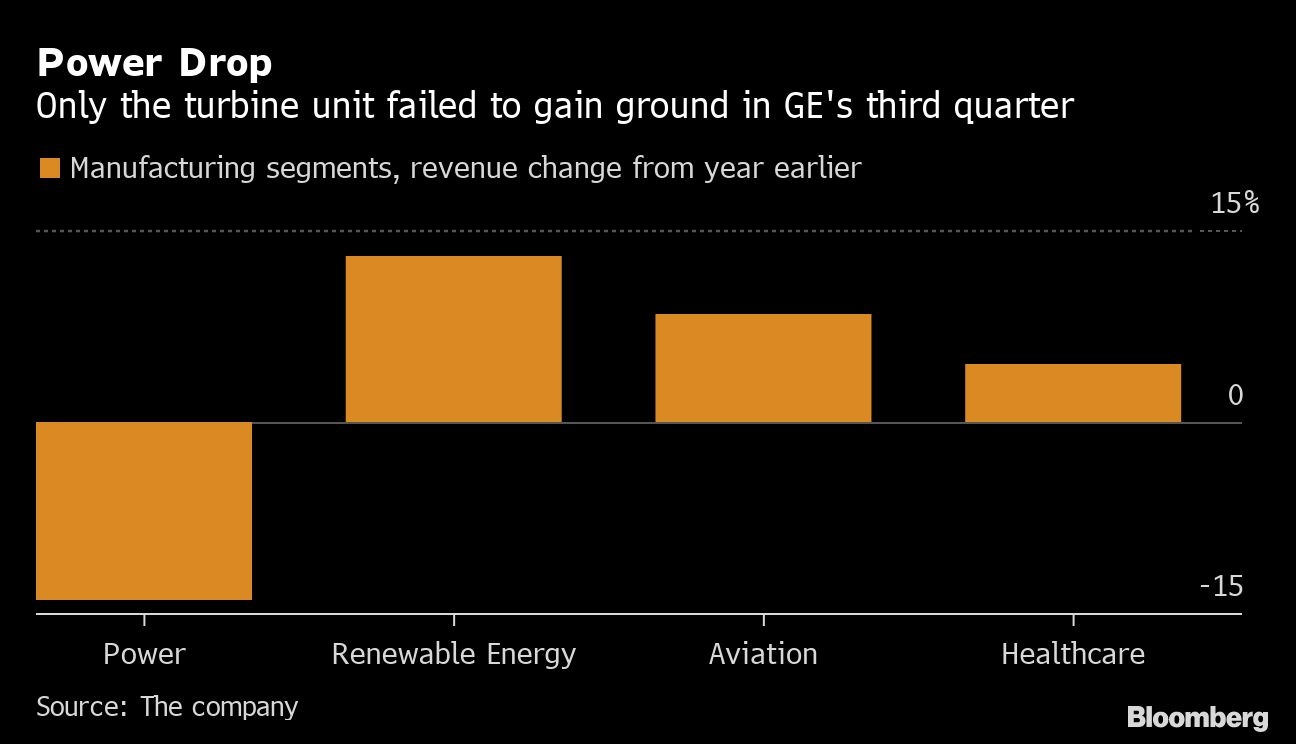

- Revenue rose 8.4 per cent at GE Aviation even as it faces challenges related to multiple Boeing Co. aircraft. The division makes engines for the 737 Max, which has been grounded since March, and 777X, the debut of which will be delayed because of an engine problem. Culp has said GE faces a cash headwind of US$400 million a quarter as long as the Max remains grounded.

- The power-equipment unit, a major concern for shareholders, struggled again in the third quarter. Orders fell 30 per cent, while sales dropped 14 per cent. Fixing the ailing business has been a top priority since Culp took the top job at GE in October 2018.

Market Reaction

- The shares jumped 4.7 per cent to US$9.50 before regular trading Wednesday in New York. GE advanced 25 per cent this year through Tuesday, compared with a 23 per cent gain in the S&P 500 index of industrial stocks.

Get More

- Culp will address shareholders and analysts during a conference call Wednesday at 8 a.m. New York time.