Nov 9, 2018

GE tumbles toward 2009 bear-market low on JPMorgan warning

, Bloomberg News

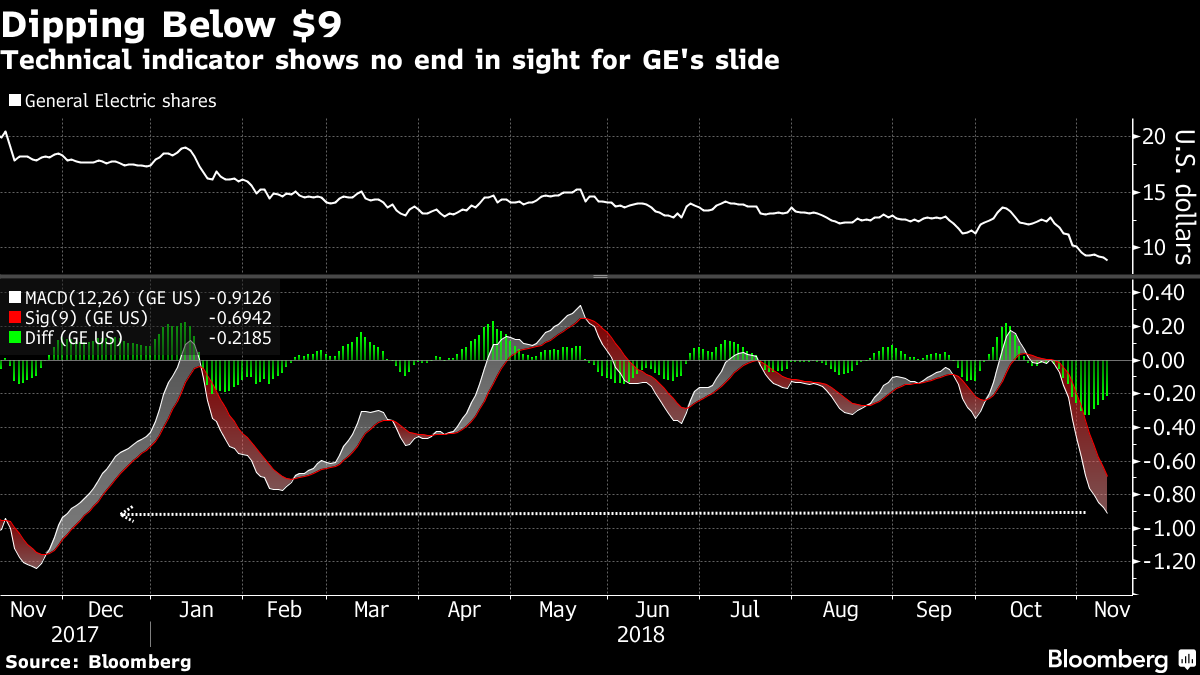

General Electric Co. (GE.N) plunged toward its recession-era low as the company’s most bearish analyst said the plummeting stock price is poised to fall further.

JPMorgan Chase & Co. analyst Steve Tusa slashed his price target to US$6, the lowest on Wall Street, citing rising liabilities, a weakening cash-flow outlook and poor third-quarter results on “almost all fronts.” He also pointed to deteriorating results at GE’s troubled power division and financial business.

“While the stock is down about 70 per cent from the peak of US$30, this move still does not sufficiently reflect the fundamental facts,” Tusa said in a note to clients.

The pessimistic view from Tusa, who has been prescient in predicting GE’s collapse in recent years, fueled a share decline that has wiped out US$200 billion in market value since the end of 2016. GE is grappling with one of the deepest slumps in its 126-year history amid weak demand for gas turbines, federal accounting investigations and heavy debt.

The shares tumbled 9.1 per cent to US$8.27 at 10:45 a.m. in New York after declining to as little as US$8.26, the lowest intraday price since March 2009. That was the same month GE fell to US$6.66, the stock’s nadir during the global financial crisis.

Reset Needed

GE announced the surprise appointment of Larry Culp as chief executive officer last month, replacing John Flannery. Culp must still face up to a weakened outlook for earnings per share, Tusa said.

“We are skeptical around calls for a bottom until management resets EPS expectations that are closer to free cash flow, something we believe they haven’t done for almost 20 years,”’ he said.

GE’s third-quarter results, reported last week, missed analysts’ estimates, while the company also slashed its dividend and revealed an expanded federal probe into its accounting.

Tusa’s concerns were echoed by Bloomberg Intelligence analyst Joel Levington, who said the company’s regulatory filings contained comments about “on- and off-balance-sheet liabilities, contingencies, lawsuits and liquidity items, which, taken together, reinforce our concerns about GE’s credit risk.”