Aug 15, 2023

Global Household Wealth Drops For First Time Since 2008 Financial Crisis

, Bloomberg News

(Bloomberg) -- Global household wealth fell last year for the first time since the financial crisis in 2008, as inflation and the appreciation of the US dollar wiped some $11.3 trillion off assets.

Total net private wealth across the world decreased by 2.4% to a total of $454.4 trillion, according to Credit Suisse’s annual global wealth report published on Tuesday. The bulk of the decline was felt in North American and European households, which lost a combined $10.9 trillion.

Not all regions suffered a hit to wealth. Despite the impact of sanctions, Russia recorded a large wealth increase during the year, adding 56 millionaires, according to the report.

Latin America saw a wealth increase of $2.4 trillion, helped by an average 6% currency appreciation against the US dollar, according to the report. The research covered the estimated holdings of 5.4 billion adults around the world and across the wealth spectrum.

“Wealth evolution proved resilient during the Covid-19 era and grew at a record pace during 2021. But inflation, rising interest rates and currency depreciation caused a reversal in 2022,” said Nannette Hechler-Fayd’herbe, the global head of economics and research at Credit Suisse. Credit Suisse was acquired by UBS Group AG earlier this year.

The decline of financial assets also reduced inequality, Hechler-Fayd’herbe said in a press call. The total number of millionaires fell by 3.5 million to about 59.4 million people, while the globe’s top 1% richest loosened their grip: their wealth share fell to 44.5%.

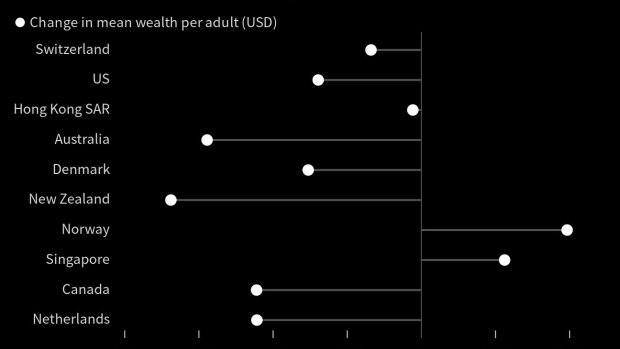

Norway, Singapore and the United Arab Emirates led the wealth gains per adult in 2022, while Sweden, New Zealand, Australia and Canada posted the largest declines.

The study’s experts predict that 2022 may just be a blip in the overall projection for wealth growth. Globally, it is set to increase by $629 trillion by 2027, or 38%. And the number of millionaires could reach 86 million by 2027 from about 60 million in 2022.

--With assistance from Diana Li.

(Adds biggest declines in 7th paragraph)

©2023 Bloomberg L.P.