Jun 13, 2021

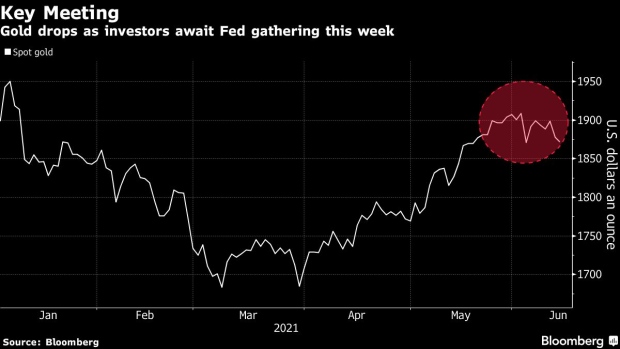

Gold Drops as Investors Await Fed Meeting for Clues on Policy

, Bloomberg News

(Bloomberg) -- Gold extended a decline as investors await this week’s Federal Reserve meeting for clues on the future path of monetary policy.

Fed officials could project interest-rate liftoff in 2023 amid faster economic growth and inflation, but they won’t signal scaling back bond purchases until August or September, according to economists surveyed by Bloomberg. More than half predict the quarterly rate-forecast “dot plot,” released after the conclusion of the central bank’s two-day gathering on Wednesday, will show the median of 18 officials penciling in at least one 2023 increase.

The remainder see no liftoff from near-zero rates until 2024 at the earliest, mirroring the Fed’s forecast in March.

Bullion retreated on Friday as the dollar and Treasury yields rebounded, with traders further digesting Thursday’s report on the U.S. consumer price index which showed that increases were largely driven by categories associated with economic re-openings, bolstering the view that inflation pressures may ease later in the year. Some investors are anticipating the Fed will reaffirm that its ultra-loose policy remains appropriate, and that it’s too soon to start even contemplating tapering bond purchases.

“It’s easy to be tactically neutral on gold here,” said Chris Weston, head of research at Pepperstone Group, who said he would look to turn bullish again on a close through $1,911. “When I look at the play book for this week’s Fed meeting, the skew of risk is to slightly higher real rates and a modestly stronger U.S. dollar. This should result in a weak gold price, although the Fed do have a tendency to keep financial conditions in check unless something needs to be done.”

Spot gold fell 0.3% to $1,871.65 an ounce at 8:50 a.m. in Singapore, after dropping 1.1% on Friday. Silver and platinum declined, while palladium steadied. The Bloomberg Dollar Spot Index was flat after rising 0.5% on Friday.

©2021 Bloomberg L.P.