Mar 16, 2023

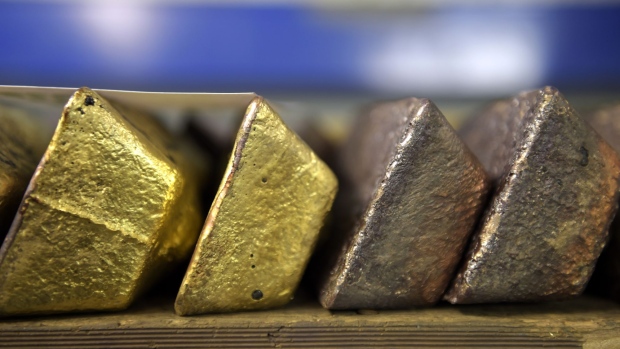

Gold Fields, AngloGold to Create Africa’s Biggest Mine in Ghana

, Bloomberg News

(Bloomberg) -- Gold Fields Ltd. and Johannesburg-based rival AngloGold Ashanti Ltd. have proposed a joint venture in Ghana that would create Africa’s largest gold mine.

Gold Fields would hold two-thirds of the venture that would combine the operations of its Tarkwa mine with those of AngloGold’s neighboring Iduapriem, the companies said in a joint statement on Thursday. AngloGold would hold the remainder of the venture, and both companies would benefit from synergies and cost savings.

“The proposed joint venture is an exciting opportunity to combine mining operations that are essentially part of the same mineral deposit and is something that Gold Fields and AngloGold Ashanti have discussed many times before over the years,” Martin Preece, interim chief executive officer at Gold Fields, said in the statement.

Gold Fields and AngloGold have shifted their focus to more profitable mines in Ghana, Australia and Latin America as the sector in South Africa dwindles. The joint venture follows gold industry trends for deals that provide scale, unlock synergies and prolong a mine’s life, said Arnold Van Graan, an analyst at Nedbank Group Ltd.

“Large-scale Tier 1 assets are getting scarcer, and having assets like these in a portfolio is becoming a boon, in our view,” Van Graan said in a note to clients, adding that the deal benefits both companies.

In the wider mining industry, combining large mines that are located next to each other but owned by different companies is an obvious way to boost production and lower costs, according to Glencore Plc CEO Gary Nagle.

Gold Fields would operate the combined venture, which would have an average annual output of almost 900,000 ounces for its first five years. Production would average 600,000 ounces of gold over the life of the mine.

Read: Gold Fields Would Consider Joint Ventures to Bolster Output

The joint venture comes after Gold Fields failed in its bid to buy Canadian miner Yamana Gold Inc. last year.

Gold Fields shares gained 0.7% by 2:04 p.m. in Johannesburg, while AngloGold declined 3.3%.

“This combination puts together two parts of the same world-class ore body, allowing us to share skills and infrastructure to significantly enhance every aspect of this mining operation, from exploration and planning, to mining and processing,” AngloGold CEO Alberto Calderon said.

(Updates with analyst comment in fifth paragraph)

©2023 Bloomberg L.P.