Nov 26, 2020

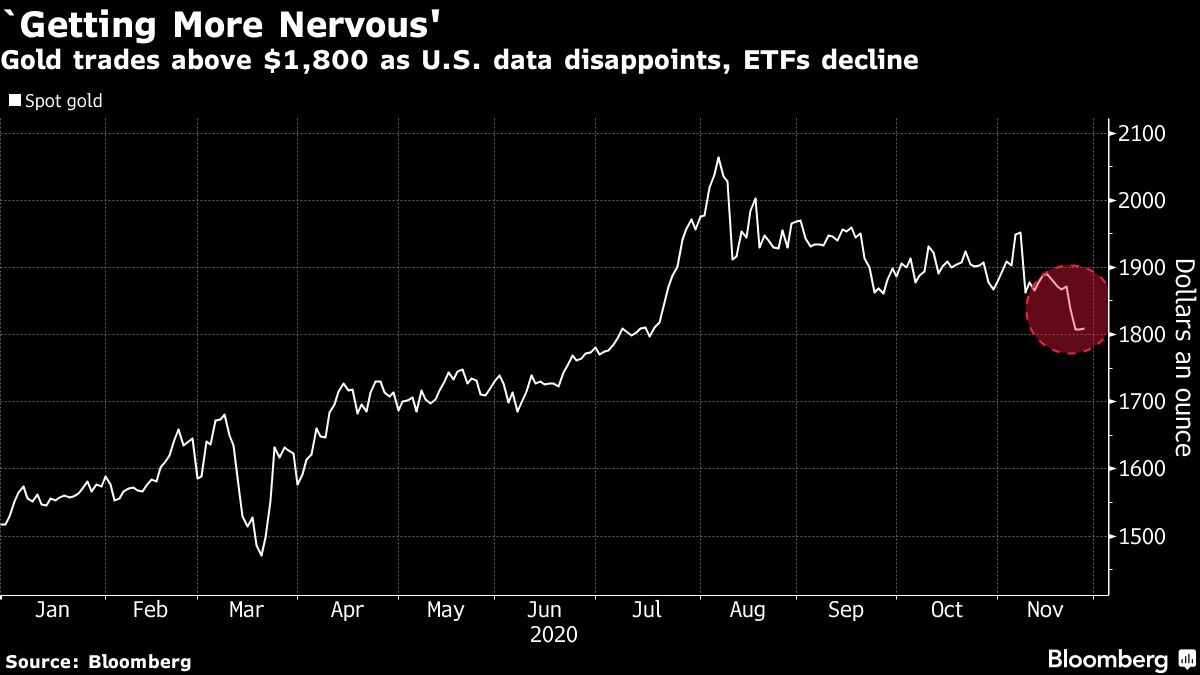

Gold hovers above US$1,800 as U.S. data disappoints, ETFs decline

, Bloomberg News

Gold continued to hover above US$1,800 an ounce after disappointing economic data pointed to a rocky recovery in the U.S., while bullion-backed exchange-traded funds saw further outflows.

Applications for U.S. state unemployment benefits unexpectedly posted the first back-to-back weekly increase since July, while Americans’ incomes and savings fell last month. The data indicate the economic rebound is becoming more tenuous amid soaring coronavirus cases, fresh lockdowns and an extended deadlock in Congress over a new stimulus package.

Still, gold prices are heading for a fourth straight monthly decline as progress on COVID-19 vaccines lifted risk sentiment and damped demand for havens. Some investors appear to be abandoning bullion, with ETFs poised to post the first month of outflows this year after holdings surged to a record in October.

“We are cautious as many investors have bought gold and they are getting more nervous,” Georgette Boele, senior precious metals strategist at ABN Amro Bank NV, said in a note. “They start to fear that we may have seen the peak. If that is the case, it could take a long time before we see the level of US$2,000 again.”

Spot gold rose 0.3 per cent to US$1,813.39 an ounce at 10:16 a.m. in London, but is still heading for a third weekly decline. Silver was little changed, while palladium gained. The Bloomberg Dollar Spot Index rose 0.1 per cent.

Minutes released Wednesday showed Federal Reserve officials discussed at their meeting earlier this month providing more guidance on their bond-buying strategy “fairly soon,” though they didn’t see a need for immediate adjustments. The Fed’s next scheduled gathering starts on Dec. 15.