May 7, 2021

Gold Posts Its Best Week Since November After U.S. Hiring Slows

, Bloomberg News

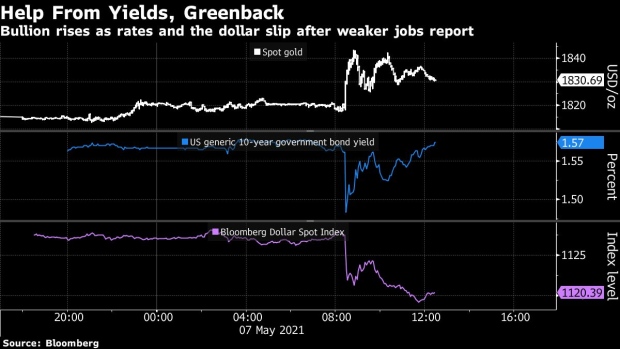

(Bloomberg) -- Gold rose for a third straight day, posting its biggest weekly increase since November after a report showed a surprise slowdown in U.S. job growth, supporting the case for continued economic stimulus and low interest rates.

Non-farm payroll numbers show the U.S. added 266,000 jobs in April, compared with the 1 million median estimate of analysts. Treasury yields sank on the news as risk appetite faded and the dollar weakened, boosting demand for gold as an alternative asset.

Gold has rebounded after a poor start to the year, when it came under pressure from gains in the dollar and bond yields. Both drivers have paused for now, while inflation expectations drive higher amid a commodities boom, lifting the metal’s appeal as a hedge. The jobs numbers reinforce views that monetary tightening remains distant, further helping non-interest-bearing bullion.

The jobs data “is lagging, but suggest that, using last month’s data there was no urgency to change policy, which is price supportive for gold,” said Giovanni Staunovo, an analyst at UBS Group AG.

Bullion surged on Thursday after several Federal Reserve officials played down concerns over inflation and pushed back on the idea of tapering bond purchases.

Spot gold rose as much as 1.6% to $1,843.43 an ounce, the highest since mid February. Prices gained 3.5% this week, the most since early November. Futures for June delivery on the Comex rose 0.9% to settle at $1,831.30 an ounce. Spot silver and platinum also advanced. Palladium dropped as much as 4.1% as traders booked profit after a price rally that sent the emission-curbing metal to fresh record highs.

The Bloomberg Dollar Spot Index retreated 0.7% after falling 0.5% on Thursday.

©2021 Bloomberg L.P.