Trump Lawyer Hints That Tabloid CEO Tried to Help Model’s Career

Donald Trump’s lawyer sought to cast doubt on claims that a tabloid publisher’s $150,000 deal with a onetime Playboy model was an attempt to influence the 2016 election.

Latest Videos

The information you requested is not available at this time, please check back again soon.

Donald Trump’s lawyer sought to cast doubt on claims that a tabloid publisher’s $150,000 deal with a onetime Playboy model was an attempt to influence the 2016 election.

Mexican companies are pushing ahead with plans to sell shares, seeking to tap renewed interest from global equity investors, according to the head of Barclays Plc in the country.

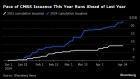

Commercial real estate was one of the scariest assets in the US last year. This year, investors are warming to it once again — and that’s helped revive a key property debt market.

Novaland Investment Group, among Vietnam’s largest real estate developers, is planning to sell shares and increase borrowings after securing bondholders’ approval to restructure $300 million of notes to address a liquidity crunch.

Signa Prime Selection AG has agreed to sell three Italian properties, including the five-star Hotel Bauer in Venice, to the Schoeller Group.

Apr 22, 2019

, Bloomberg News

(Bloomberg) -- Welcome to Tuesday, Asia. Here’s the latest news and analysis from Bloomberg Economics to help get your day started:

To contact the reporter on this story: Michael Heath in Sydney at mheath1@bloomberg.net

To contact the editor responsible for this story: Nasreen Seria at nseria@bloomberg.net

©2019 Bloomberg L.P.