May 20, 2022

Goldman Sachs Says Crypto Drawdown Has Little Impact on Economy

, Bloomberg News

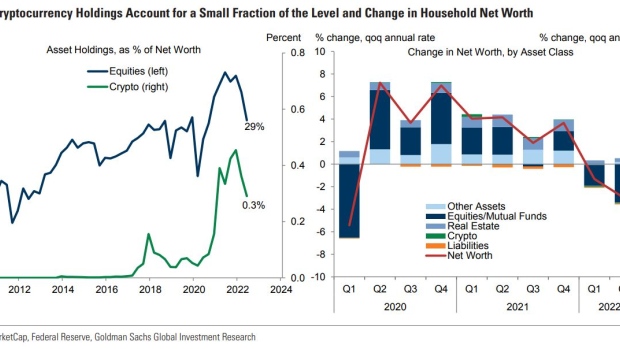

(Bloomberg) -- US households might own about one-third of the global cryptocurrencies market, but that doesn’t mean the recent downturn will have a huge effect on the economy.

That’s according to economists at Goldman Sachs Group Inc., who note that the recent selloff in digital assets is “very small” relative to overall household net worth, which last year stood at $150 trillion. Crypto markets have slumped in value to about $1.3 trillion, down from $2.3 trillion late last year.

“We therefore expect any drag on aggregate spending from the recent declines in cryptocurrency prices to be very small as well,” the economists led by Jan Hatzius wrote in a note on Thursday.

Amid a selloff in cryptocurrencies and the stock market, economists and market watchers are attempting to tally just how much the US consumer could be hit. One study has found that every dollar lost in stocks leads to a 3-cent reduction in spending. After the five-month selloff, that equates to about $300 billion zapped this year. The impact on wealth is receiving renewed attention because consumer spending makes up 70% of GDP, and many on Wall Street are predicting the economy could fall into a recession soon.

Read more: Cratering Markets Blowing a Bigger Hole in Consumer Psychology

Crypto holdings account for just 0.3% of household net worth, according to Goldman Sachs, compared with equities, which accounted for around 33% at the end of 2021. Their recent price declines have likely reduced household net worth by about $8 trillion.

“These patterns imply that equity price fluctuations are the main driver of changes in household net worth, while cryptocurrencies are only a marginal contributor,” Goldman Sachs economists wrote.

Meanwhile, the bank sees “limited scope” for an increase in labor-force participation due to crypto prices declining. Studies have, in the past, found that changes in net worth can sometimes significantly affect people’s participation in the labor force.

Yet “cryptocurrency investors skew younger and male, a demographic group whose labor force participation has generally been less affected by wealth fluctuations,” they wrote.

©2022 Bloomberg L.P.