Nov 2, 2022

Goldman Says Hawkish Fed Favors EM Currencies With US Exposure

, Bloomberg News

(Bloomberg) -- Emerging-market currencies with strong links to the US economy are set to outperform in the wake of a hawkish Federal Reserve, according to Goldman Sachs Group Inc.

The US is more likely than other developed-market peers to avoid a recession and the dollar’s strength may continue for some time, strategists including Kamakshya Trivedi wrote in a note. That means developing nations with ties to the world’s biggest economy are well placed to withstand the impact of rising interest rates and deepening fears of a global downturn.

Investors should “find currencies that are strongly linked to a resilient US growth outlook, but feature limited exposure to potential activity wobbles in Asia and Europe,” the strategists wrote, adding that the Mexican peso and Brazilian real are among the top picks. South Korea’s won is also favored although it would require a “sustained reopening impulse” in China to outperform.

Money managers are likely to turn more selective on emerging-market assets as the dollar rises on the Fed’s warning that US interest rates will go higher than earlier projected. This may spell trouble for the likes of the Indian rupee and offshore yuan which have tumbled to record lows, with slowing growth in China adding to the risks to the outlook.

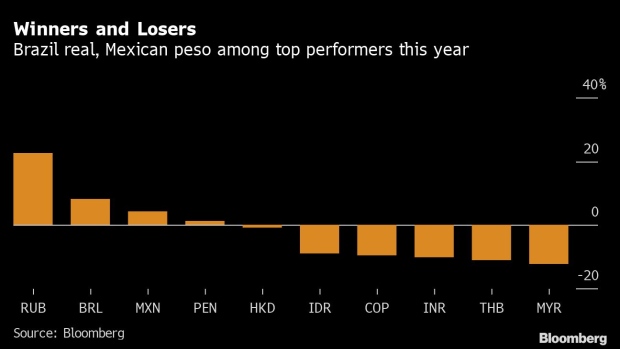

Brazil and Mexico, which counts the US among their biggest trading partners, have lured investors with high yields as they aggressively raised interest rates to tame inflation. The real and Mexican peso are the among the best-performing emerging currencies this year, gaining over 8% and 4% against the dollar, respectively.

Top Trades

Goldman recommends funding long real and peso trades using lower-carry currencies from emerging markets and Group-of-Nine nations. They’re also positive on Israel’s shekel due to its limited exposure to Chinese growth expectations.

They, however, caution that the peso remains sensitive to severe risk drawdowns, and the shekel would require a positive environment for global equities to outperform.

The firm also recommends investors look for currencies with good carry, and to target the “new kids” on the dollar bloc -- currencies that are holding up well against broad strength in the greenback.

“A second approach to identifying pockets of EM resilience during a US cycle extension is to identify those EM currencies that, relative to their history, are trading with resilience to broad dollar upside,” they wrote. Brazil’s real and Mexico’s peso once again feature strongly in this scenario, the strategists said.

©2022 Bloomberg L.P.