Oct 16, 2022

Goldman Sees Some Bargains in US But Finds S&P 500 Expensive

, Bloomberg News

(Bloomberg) -- Goldman Sachs Group Inc. sees attractive opportunities emerging in US stocks even as the S&P 500 benchmark remains expensive versus its history and accounting for interest rates.

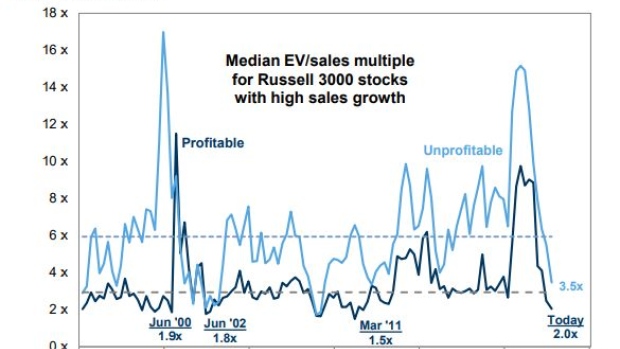

The risk-reward for the S&P 500 Index remains unattractive but “the degree of valuation dispersion within the equity market is wide,” strategists including David J. Kostin wrote in a note dated Oct. 14. They see opportunities in stocks linked to quicker cash flow generation, value, profitable growth, cyclicals and small caps.

Goldman’s note highlighting some bargains came on a day when the S&P 500 benchmark closed below its base-case year-end target of 3,600. The gauge remains expensive relative to history and current interest rates, Kostin and team wrote.

While the S&P 500 Index has dropped 25% this year amid concerns that the Federal Reserve’s policy tightening will push the US economy into a recession, it’s still 12% above Goldman’s hard-landing scenario target of 3,150.

Read: Goldman Picks Quality, Liquid Bets as Diversification Play Fails

Among companies generating cash flow faster than others, Goldman likes retail store operator Macy’s Inc. and carmaker General Motors Co. Profitable growth stocks that it considers to be bargains include biotechnology company Exelixis Inc. and Facebook-parent Meta Platforms Inc.

Cyclical stocks that it sees as cheap even in the event of a recession include builders PulteGroup Inc. and Toll Brothers Inc., as per Goldman’s analysis.

©2022 Bloomberg L.P.