Apr 19, 2021

Government budgets: Is the bond market broken for the average investor?

By Larry Berman

Larry Berman: The risk of owning fixed income

The regulators tell financial advisors that their clients need to have portfolios linked to their risk tolerance. Historically, this was accomplished with fixed income in portfolios. The rule of thumb was that the older you are, the safer your portfolio should be and the more fixed-income you should have.

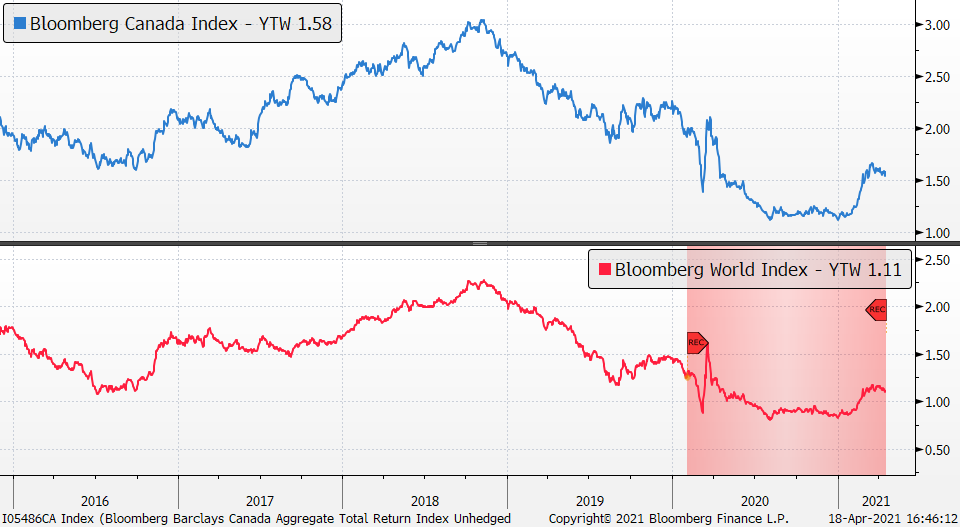

The problem for years now has been that bond yields have hit a level where the investor is worse off every year after inflation (tax and fees). For Canada, the entire bond market has a yield-to-worst (similar to yield-to-maturity adjusted for callable features) of 1.58 per cent. For the entire world of investment grade fixed-income, the YTW is 1.11 per cent. They first came crashing down in the period around the European debt crisis in 2012 when Mario Draghi expressed that they would do what it takes. It happened again around the surprising results of the BREXIT vote in 2016 and those lows were shattered in the first few months of COVID-19 in 2020.

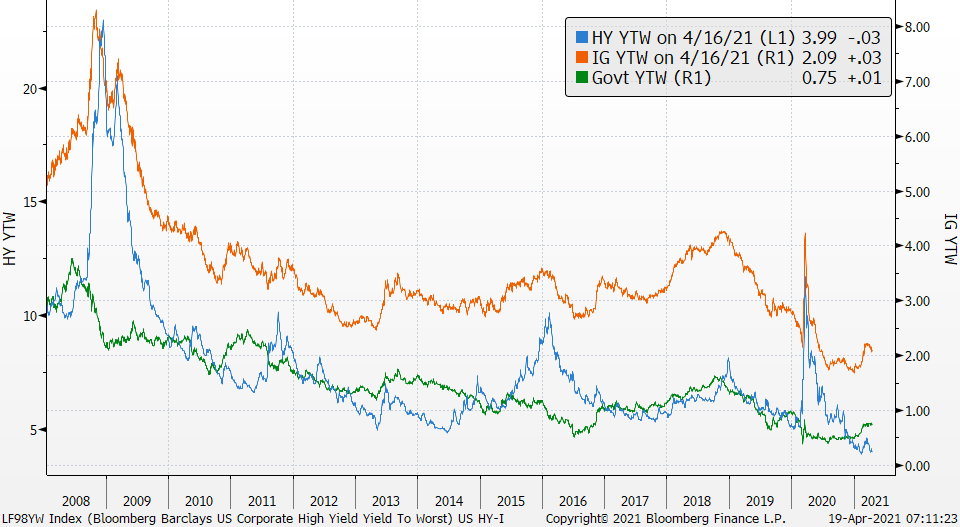

There is rarely a week that goes by where we don’t get a question on Berman’s Call that sounds something like: My bonds (GICS) don’t meet my needs, can you recommend a dividend paying stock that has 4-6 per cent return please? This central bank intervention, which forced yields lower, has lead many investors into higher yielding bonds without necessarily understanding the risks. It’s like asking for a dividend stock to replace fixed-income: there is a dramatically different risk profile to high yield (junk) bonds or equities compared to investment grade securities or government debt.

The chart shows how low credit spreads are and it’s unbelievable how tight junk bond spreads are, they are clearly the riskiest they have ever been. Investors are simply not being compensated for the extra yield. Even in the high quality investment grade universe, a yield of barely over 2 per cent does not keep up with prevailing inflation expectations.

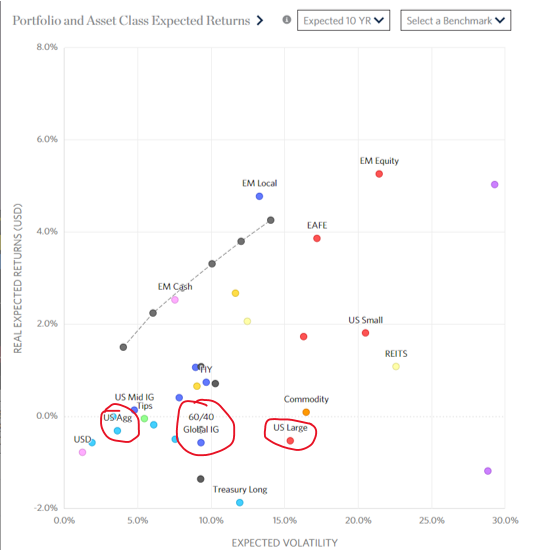

To make matters worse, now adding that the central banks of the world seem to want more inflation makes owning bonds even riskier. In an environment of creeping inflation expectations, even safe government bonds are not such good stores of (real) value either.

The bond supply coming in the next few years as deficits are exploding will make balance in portfolios an increasing challenge. The Federal Reserve and the Bank of Canada talk about normalizing, which is laughable since they will be forced to monetize debt as far as the eye can see. I can’t wait to hear when Canada will balance its budget again!

This week in our weekly Thursday Spring 2021 Berman’s Call virtual roadshow, we will focus on budgets, taxes and the use of fixed-income in your portfolios in the years to come. Register at www.etfcm.com or at www.investorsguidetothriving.com for a 30 to 40 minute weekly presentation that changes each week to current market developments followed by a 30 to 40 minute Q&A session.

Subscribe to my new YouTube channel LarryBermanOfficial which is the new site for all our educational content and my new weekly market recap and ETF bull and bear picks of the week.

Follow Larry:

YouTube: LarryBermanOfficial

Twitter: @LarryBermanETF

Facebook: @LarryBermanETF

LinkedIn: LarryBerman