Mar 7, 2024

Green Groups Decry SEC’s Climate Disclosure Rule as Too Weak

, Bloomberg News

(Bloomberg) -- Another piece of the Biden administration’s sweeping policy response to climate change fell into place Wednesday, when the US Securities and Exchange Commission voted to approve highly anticipated climate disclosure requirements for public companies.

Environmental advocates long pushed for such disclosures. But their immediate response was largely negative, with many saying the rule falls far short of what’s needed and leaves investors lacking crucial information about climate risks.

Leslie Samuelrich, president of the sustainability-focused mutual fund company Green Century Funds, said, “It’s a step forward, but we feel it’s too little, too late.”

“Investors deserve better than where the SEC landed with its disclosure rule,” said Hana Vizcarra, a senior attorney at the group Earthjustice, in an emailed statement.

The SEC’s new rule is groundbreaking in that it requires public companies to make certain climate disclosures, mainly reporting of greenhouse gas emissions, for the first time. Large public companies will be required to disclose their direct, or Scope 1 and Scope 2, emissions. Notably, they must do so only if they deem them “material” — significant to their bottom line.

But it’s what didn’t end up in the final rule — adopted in a 3-2 vote along party lines, with Democrats supporting and Republicans opposing — that has most disappointed sustainable investors and climate groups. There’s no requirement that businesses disclose the larger portion of their carbon footprint: the indirect, or Scope 3, emissions linked to a company’s supply chain and customers. That’s a significant watering down of what was first proposed in March 2022, and less stringent than what’s required in the European Union.

Read More: Why the ‘Scope’ of Carbon Emissions Matters

There are big financial risks and opportunities linked both to climate impacts and the clean energy transition, said Cynthia Hanawalt, director of the financial regulation practice at Columbia University’s Sabin Center for Climate Change Law. “Investors are the primary audience” for the rule, she said.

Investors already seek climate information to guide their decisions and many companies voluntarily disclose climate risks, which is what prompted the SEC to delve into the issue in the first place. “It’s in this context that we have a role to play with regard to climate-related disclosures,” SEC Chair Gary Gensler said Wednesday. “Today’s rules enhance the consistency, comparability, and reliability of disclosures. The final rules provide specificity on what must be disclosed, which will produce more useful information than what investors see today,” he added.

Sustainable investors and environmental groups are skeptical that the rule achieves all of that, and point to the absence of Scope 3 emissions as the main reason why. Ceres, the Clean Air Task Force, the Sierra Club and Public Citizen are among the climate groups that have raised concerns about the omission.

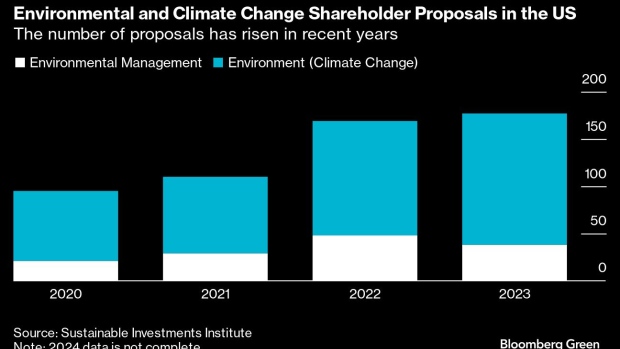

The decision not to require disclosure of Scope 3 emissions is “very short sighted,” said Danielle Fugere, president of the shareholder activist group As You Sow. Since other countries are starting to require this information, “I expect companies will continue to be under pressure to report more than what’s required,” she said. As You Sow has worked with investors to file shareholder resolutions pushing companies to disclose their full greenhouse gas emissions, and Fugere said she anticipates those efforts will continue despite the rule’s narrower scope.

The most important climate information that investors say they need is greenhouse gas emissions data — “that’s the source of risk,” said Allison Herren Lee, a former SEC acting chair and commissioner and an attorney at Kohn, Kohn & Colapinto. “Only a sliver of that risk” is being disclosed under the agency’s new rule, she said, like the exposed part of an iceberg when a much bigger danger lurks below the water.

Lee noted that the question of whether Scope 1 and 2 emissions are “material” is left to the discretion of companies, a change from the proposed rule. Companies may be “incentivized to conclude Scope 1 and 2 emissions are not material,” she said, or may try to game their emissions to be lower than if they had to disclose their emissions across the supply chain.

Even SEC Commissioner Caroline Crenshaw, a Democrat who voted for the final rule, expressed disappointment. The rule does “not have my unencumbered support,” she said, given that “important disclosures remain absent.”

Seeming to refer to the recent political controversy over ESG, Crenshaw said, “That the term ‘climate’ has become a buzz word should be of no moment to a clear-eyed commission. It should not compel us to shy away from our duties and obligations to investors.” The SEC said it weighed thousands of comments on the proposed rule before finalizing it. Industry groups and conservative lawmakers had voiced strong opposition, saying the commission was stepping beyond its jurisdiction with the rulemaking and that Scope 3 emissions disclosures would be onerous and costly for companies to report.

The Sierra Club and the Sierra Club Foundation said in a statement that they are now weighing a move to challenge the commission’s “arbitrary removal of key provisions” from the final rule.

Meanwhile, 10 Republican-led states — including West Virginia, Georgia and Alaska — filed a petition for review Wednesday in the 11th Circuit Court of Appeals, alleging the SEC’s rule “exceeds the agency’s statutory authority” and calling it “an abuse of discretion.”

The US Chamber of Commerce is still reviewing the “novel and complex” text of the rule, Tom Quaadman, executive vice president of the Chamber’s Center for Markets Competitiveness, said in a statement, adding that the “most onerous provisions” from the proposed rule had been dropped. The Chamber is among the business groups that filed a lawsuit earlier this year challenging California’s emissions disclosure law, which requires large public and private companies doing business in the state that make over $1 billion in annual revenue to disclose their Scope 1, 2, and 3 emissions annually.

The final SEC rule comes as climate impacts are wreaking havoc across the US and the world. Last year the US experienced a record 28 disasters that each caused at least $1 billion in damages, according to the National Centers for Environmental Information.

“The climate risk has gone up exponentially,” said Steven Rothstein, managing director of the Ceres Accelerator for Sustainable Capital Markets.

©2024 Bloomberg L.P.