Aug 24, 2022

Hawkish Fed at Jackson Hole Is Poised to End Dollar Rally

, Bloomberg News

(Bloomberg) -- The dollar’s recent rally should soon cause global trade -- and therefore demand for dollar-denominated assets -- to decline, leading to a weaker US currency. The catalyst for such a drop could, paradoxically, be a more hawkish Federal Reserve at this week’s Jackson Hole gathering.

Yields and yield curves indicate flow-driven demand for the dollar and USD assets, while the level of the dollar has implications for the stock of these assets. A higher dollar makes it more expensive for foreign borrowers of dollars to service their debt, generating deleveraging pressure. It also makes the cost of buying new dollar assets more expensive in foreign-currency terms.

But the big driver of global capital flows is trade. Capital flows are the flip side of trade flows, and trade imbalances create capital imbalances which drive capital flows.

Virtually all major commodities are traded in USD (apart from a few notable exceptions such as wool, in Australian dollars). Therefore a rising dollar eventually depresses global trade as the price of everything rises in foreign-currency terms. Global trade is faltering as the dollar is rising, which means capital flows are falling.

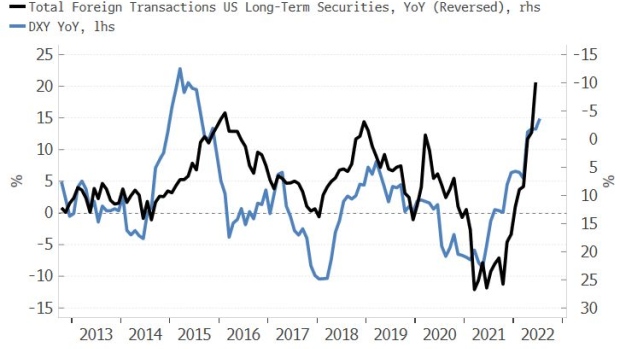

Deleveraging pressure driven by the dollar’s strength and a slowdown in primarily USD-denominated global trade are therefore leading to a fall in foreign transactions of US assets.

From last December to June, foreign holdings of long-term US financial assets have fallen from $27.3 trillion to $23.5 trillion, with the DXY rising almost 13% over the same period. Foreign transactions of US assets are declining 10% on a year-on-year basis.

Jackson Hole may be the buy-the-rumor-sell-the-fact catalyst for the dollar to head lower, especially if Fed Chair Jerome Powell leans hawkishly.

Expectations are that Powell uses the symposium to re-state the Fed’s hawkish determination to combat inflation. In anticipation, yields have been rising, and the dollar has had a renewed lease of life, rallying against all G-10 currencies over the last couple of weeks.

Yield differentials favor the dollar for almost all G-10 currencies (with New Zealand the only notable exception). But nominal and real yield differentials do not have a robust leading relationship with the dollar.

One of the best leading relationships for the dollar is given by the real yield curve. After aggressively steepening for most of the last year, it is now clearly rolling over, suggesting the dollar will soon encounter headwinds.

As front-end real yields rise by more than long-term ones, the real return for foreign investors in US Treasuries is falling. The flattening of the real yield curve thus points to oncoming dollar resistance.

The Japanese are the largest buyer of Treasuries, and have been notably absent in the market this year, as FX hedging costs rise -- driven by sharply rising short-term rates in the US -- and the yen weakens.

The real yield curve would face further flattening pressure if Powell leans hawkishly at Jackson Hole, especially if the market continues to believe a cutting cycle could start as early as next year. Thus paradoxically a more hawkish Fed sets in play greater resistance for the dollar in the medium term, after any knee-jerk reaction.

But even if Jackson Hole leaves the dollar unscathed, its baked-in strength soon threatens to be the rally’s undoing.

- NOTE: Simon White is a macro strategist for Bloomberg’s Markets Live blog. The observations he makes are his own and not intended as investment advice. For more markets commentary, see the MLIV blog

©2022 Bloomberg L.P.