Jan 18, 2023

Hedge Funds Cover Treasury Shorts at Fastest Pace in Four Months

, Bloomberg News

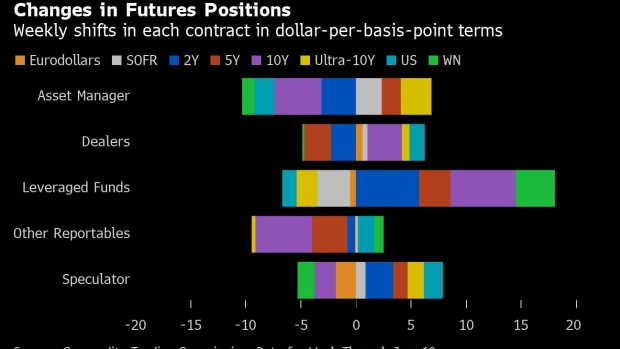

(Bloomberg) -- Hedge funds rushed to cover their Treasury short positions in the lead up to December inflation data as talks of a brewing recession heat up.

The action was on display in futures last week, where a combined 170,000 of 10-year note equivalents were covered by the money managers, the biggest drop in bearish duration wagers since September. Short bets in two- and 10-year note futures were cut the most, as traders started to ramp-up expectations that the Federal Reserve will move to a downsized 25 basis-point rate hike at the February meeting, rather than continuing on the current path of 50 basis-point increases.

In the cash space, JPMorgan’s latest Treasury client survey showed that investors are now the most neutral on duration since September 2011, implying uncertainty on the immediate path of Treasury yields has reached a peak.

Rush to Cover

Aggressive short covering was seen from hedge funds for a combined 170,000 10-year futures equivalent in the week up to Jan. 10, the biggest decline in net-short duration since September.

Most of the short covering from hedge funds took place in two- and 10-year note futures, while the combined paring of short positions across two-, five-, 10- and ultra-long bonds amounted to $18.1 million per basis point in risk. Hedge fund net short in two-year note futures is now the least since October.

Neutral Skew

On Wednesday, with 10-year yields trading at the lowest levels since September, skew on 10-year note futures has edged back to neutral as investors pay a lesser premium on protection against a bigger Treasuries selloff. Of note this week, a $5 million play in weekly 10-year options targeted a rise in yield to approximately 3.75% before Friday’s expiry.

Front-End Blocks Active

Last week saw elevated block trades in two-year note futures, where over 100,000 traded via blocks execution, more than double any other tenor. Highlights included an 11,500 seller at 103-01 which printed Jan. 12.

Put Condor in Play

Heat-map on 10-year options continues to highlight a large condor trade in March puts targeting a yield range of 3.75% to 3.90%.

©2023 Bloomberg L.P.