Sep 26, 2022

High-Grade Bonds Attract Junk Buyers as Yields Hit 13-Year Peak

, Bloomberg News

(Bloomberg) -- Yields on blue-chip corporate debt have jumped high enough to attract some unlikely buyers: junk-bond investors.

The average yield on the lowest-rated tier of investment-grade bonds hit 5.75% on Friday, the highest since 2009, when companies were recovering from the financial crisis. That’s what the best quality junk borrowers were paying as recently as June, but investment grade has much less credit risk.

“High-yield investors should extend into investment grade as much as their mandates allow,” wrote Oleg Melentyev and Eric Yu, strategists at Bank of America, in a note on Friday. “A 5%-7% yield in credits largely agnostic to recessionary outcomes is not often seen.”

High-yield money managers’ investment policies typically allow them to hold other kinds of debt. Oaktree Capital Management’s Danielle Poli has been buying more investment-grade securities given better valuations.

“For a 5% yield with very safe underlying company fundamentals, it’s a good place to hold cash in our portfolio until we await better opportunities,” said Poli, co-portfolio manager for Oaktree Capital Diversified Income Fund.

One reason yields jumped on BBB rated bonds is that investors are worried about them being cut to junk, which typically results in a steep drop in price, said Bill Zox, a high-yield portfolio manager at Brandywine Global Investment Management.

“Dedicated investment-grade managers are staying away from BBBs,” Zox said. “That can result in low BBBs getting attractive compared to BBs.”

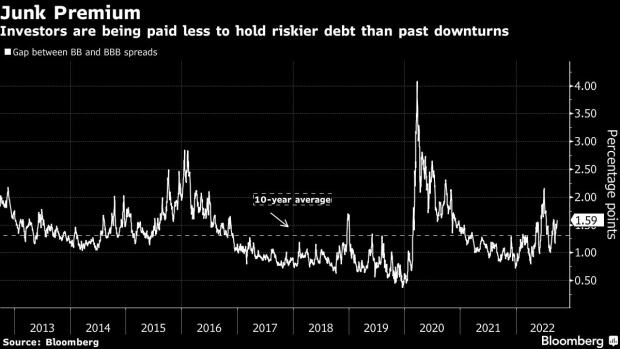

The difference between spreads on BBB and BB bonds is about 1.6 percentage points, lower than in past downturns. As a result, investors aren’t getting paid significantly more for taking extra credit risk.

“We are going into a slow-growth environment, so the premium should be larger,” Vishal Khanduja, co-head of US multi-sector fixed income at Eaton Vance. “That’s why we are preferring to own more BBBs, or investment-grade companies, versus BBs. The goal here is to be a little bit safer, a little bit more high quality.”

In the BBB market, CreditSights Inc.’s Winnie Cisar, global head of strategy, recommends debt from the likes of General Motors Co., HP Inc. and Warner Bros. Discovery Inc., given spreads that are wider than debt with the same rating.

“BBB valuations, especially on a yield basis, are compelling when compared to pre-pandemic levels,” strategists led by Cisar wrote in a note dated Sept. 14.

‘Rare Opportunity’

Bank of America strategists not only recommend buying higher-quality assets as risks of a recession loom -- they also see value in purchasing bonds with higher duration.

“Our strongest conviction is in high quality, investment-grade, and longer duration segments of the market, where we think value is back in a big way,” the strategists wrote.

At current levels, BBB notes are “a rare opportunity,” the Bank of America strategists add.

To be sure, high-grade debt is hardly a slam dunk. Given its higher duration than junk, there is more interest-rate risk at a time when the Federal Reserve is hiking rates, and BBB notes have lost almost 18% this year.

But some BBB rated bonds have lower duration than the average for high-grade. For example, a T-Mobile USA bond due in April 2030 with a 3.875% coupon yields about 5.7%.

Elsewhere in credit markets:

Americas

About five companies looking to sell new bonds in the investment-grade primary market on Monday stood down due to volatility.

- Month-to-date investment-grade volume stands at just $76.9 billion -- less than the $77 billion that priced in just the initial four sessions following Labor Day last year

- Lumen announced a debt tender offer, according to a statement Monday

- US junk bond yields have risen to a more than two-year high across ratings

- CCCs, which are the riskiest and most growth-sensitive part of the market, are poised to end September with the biggest loss in three months

- So far this month, they’ve posted losses of 3.18%

- CCCs, which are the riskiest and most growth-sensitive part of the market, are poised to end September with the biggest loss in three months

- For deal updates, click here for the New Issue Monitor

- For more, click here for the Credit Daybook Americas

Europe

Companies that need to refinance bonds have never been faced with costs this high.

- UK bonds plunged as traders ramped up bets on rate hikes by the Bank of England; British banks’ riskiest bonds fell, as did sterling-denominated junk

- Some UK credit market watchers say they’re waiting for the right moment to come back in

- Creditors of Spanish steelmaker Celsa Group have submitted a restructuring plan that would see them take control of the company and reduce a 2.8 billion euro ($2.7 billion) debt pile by almost half

- Matalan Ltd. reached an agreement to extend a key bond maturity and start a sale process after months of negotiations with its creditors

- Credit Suisse is said to be looking at possible asset and business sales to dive down costs and restore profitability

Asia

Concern is growing among investors that central bank policy tightening to tame inflation may cause a global recession, and that’s sparking increases in dollar bond spreads and debt insurance costs in Asia excluding Japan.

- Despite mounting signs of a sharp slowdown in growth, Bloomberg Intelligence says that policy makers will continue to raise interest rates; it forecasts that the GDP-weighted global central bank rate will rise to 5.1% at the end of 2022 from 2.9% at the end of last year

- In Japan, its usually staid yen corporate bond market hasn’t escaped the global debt rout: that market is poised for its first annual loss since 2011 amid the yen’s plunge versus the dollar

©2022 Bloomberg L.P.