May 7, 2021

Hillhouse Builds Investing War Chest With $18 Billion Raise

, Bloomberg News

(Bloomberg) -- Hillhouse Capital Management Ltd. is close to completing its latest fundraising series, attracting $18 billion to back three new funds for the Hong Kong-based investment firm, according to people familiar with the matter.

The company is replenishing its war chest as the coronavirus-battered economy throws up opportunities, the people said, requesting not to be identified because the matter is private. Hillhouse attracted funding from endowments and pension funds, and is nearing a close though final details may change, the people added. Hillhouse declined to comment in an emailed statement.

The $18 billion raised is higher than the original target of about $13 billion as of April last year, people familiar said. About $10 billion was to be allocated to buyouts, with the rest split between growth equity and venture, one person said at the time.

Founded by Yale alumnus and billionaire Zhang Lei about two decades ago, the firm has mushroomed from a boutique hedge fund into a $100 billion behemoth that’s made prescient bets on stocks, venture capital and private equity deals.

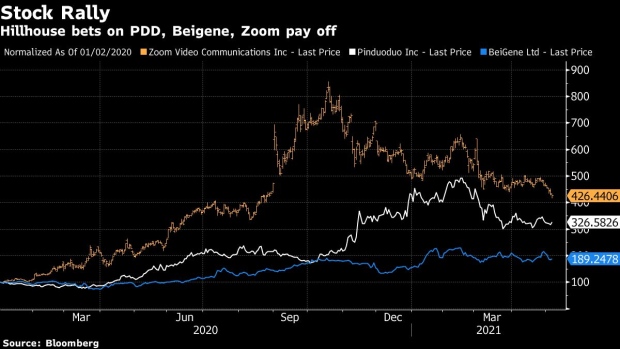

A raft of initial public offerings in the past year have helped generate significant returns for Hillhouse including JD Health International Inc., Perfect Diary, Miniso Group Holding Ltd. and XPeng Inc. It’s also backed Pinduoduo Inc., BeiGene Ltd. and Zoom Video Communications Inc.

Zhang, who named the firm after a street on the Yale campus, is worth at least $5.9 billion, making him one of the richest financiers, according to the Bloomberg Billionaires Index.

Existing backers for its Hillhouse Capital Fund IV included the Canada Pension Plan Investment Board, San Francisco Employee’s Retirement System and the University of Texas Investment Management Co. That fund raised $10.6 billion, according to data compiled by Bloomberg.

(Updates with size of fourth fund in final paragraph)

©2021 Bloomberg L.P.