Oct 26, 2022

Hong Kong Pension Fund’s Biggest Plunge Since 2008 Fuels Anger

, Bloomberg News

(Bloomberg) -- A historic selloff in Hong Kong stocks has dealt a blow to the nest eggs of the city’s millions of workers, saddling them with losses of about $8,000 each that may take years to recover.

The Mandatory Provident Fund -- Hong Kong’s official pension system -- shed about HK$286 billion ($36.4 billion) this year as of Monday, or HK$62,400 per member, according to researcher MPF Ratings Ltd. That puts the MPF’s year-to-date loss at around 24%, on track for its worst annual performance since 2008.

Introduced in 2000 to prepare for a rapidly aging population, the fund mandates participation for most employees in the city, and is notoriously hard to withdraw. That plan is drawing frustration at a time when stocks in Hong Kong are seeing a relentless slide, with President Xi Jinping’s tightening power grip casting greater uncertainties over the outlook for financial markets.

Read: ‘Frustrated and Angry,’ Global Funds Worry About Xi’s New China

“The worst thing about the MPF is there’s nowhere to hide. You can’t choose 100% cash,” said 50-year-old Castor Pang, former head of research at Core Pacific-Yamaichi International. “It’s like the government is forcing you to gamble,” he said. Pang switched most of his MPF assets to defensive funds in May, but still has to suffer a single-digit loss this year.

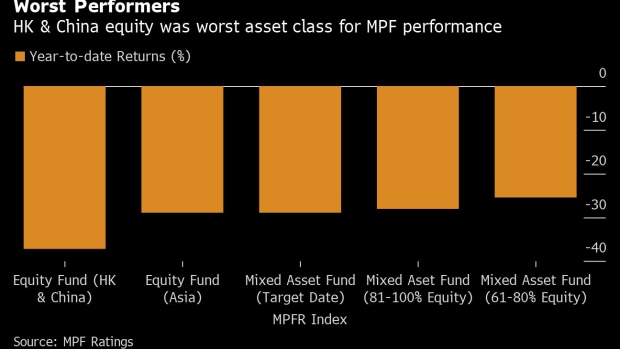

The steep losses in funds were driven by Hong Kong and China equities, the pension pot’s largest asset class. Stocks in the city, a majority of which are mainland firms, are hovering near their lowest since the 2008-2009 global financial crisis, as Xi’s new term fuels worries that polices like Covid Zero and the state’s curbs over private enterprise may continue.

While sentiment has recovered somewhat from a post-Party congress rout, Hong Kong’s benchmark Hang Seng Index remains down 33% this year, while another gauge of Chinese firms listed in the city has lost 35%, among the worst worldwide. Approximately 21% of MPF members’ money is invested in local shares, according to Francis Chung, chairman of MPF Ratings.

“I feel angry, sad, disappointed and frustrated. I can’t retire now,” said Lam, a 44-year-old analyst at a European asset management firm, asking to be quoted only by his last name when discussing personal investments. After losing 30% over the past year, he recently moved some of his retirement money out of China and into balanced funds with more exposure to government bonds.

Part of the frustration also stems from a system that allows pension savings to fall into the hands of private asset managers, creating a lucrative business for them. Investment returns are largely dependent on the performance of a range of funds offered by providers such as HSBC Holdings Plc and Manulife Financial Corp.

Residents are free to choose their own products within the pool, but employers and employees are mandated to each contribute 5% of a worker’s monthly salary in to the scheme. The MPF has about 4.4 million contributing accounts in Hong Kong and about HK$1 trillion in assets as of June.

To be sure, Hong Kong’s pension scheme isn’t alone in reporting losses as markets worldwide are slumping. South Korea’s National Pension Service reported a negative 8% return for the first half of this year, while Canada’s largest pension saw a 4.2% loss in the fiscal first quarter.

Still, the city’s long-term savings vehicle has come under criticism for its rigid system that prevents residents from early withdrawal of funds -- unless in exceptional cases including a permanent departure from the territory. The annualized net rate of return since the MPF’s inception in December 2000 was 2.8%, according to official data as of June.

The MPF is a long-term investment and it is “inevitable that there will be economic cycles over such a long period of time,” the Mandatory Provident Fund Schemes Authority said in a statement. “MPF scheme members should not be overly concerned about short-term market volatilities.”

Even with long-term recovery hopes, for Kung, a 28-year-old policy researcher at an international firm, the government-mandated scheme has been disappointing.

“There’s nothing we can do about it. Better grit my teeth and wait for the market to turn around,” he said, who didn’t want to disclose his first name because of sensitivity at work.

(Updates with latest market moves in 6th paragraph.)

©2022 Bloomberg L.P.