Sep 21, 2018

Horizons marijuana ETF adds Tilray after missing out on wild ride

, Bloomberg News

An exchange-traded fund that tracks the marijuana industry will add Tilray Inc. to its holdings on Friday, after it missed out on the action when the Nanaimo, B.C.-based pot company’s stock took investors on a wild ride this week.

Mark Noble, senior vice president of ETF strategy at Horizons ETFs Management Inc., told BNN Bloomberg in an interview that Tilray (TLRY.O) will be included in the firm’s Horizons Marijuana Life Sciences ETF, or HMMJ, holdings starting Friday.

“I’m sure people look at that and say, ‘What are you doing?’” Noble said, when asked about Tilray’s sky-high market valuation.

“A lot of people are talking about valuations of marijuana stocks right now and clearly they’re eye-popping … but what’s important to understand is that there is a real business here,” Noble added.

“The question is what stocks are going to be the winners? Are we buying Palm Pilot or Apple? Are we buying Pets.com or Amazon.com? Our view has always been to be as broad as possible.”

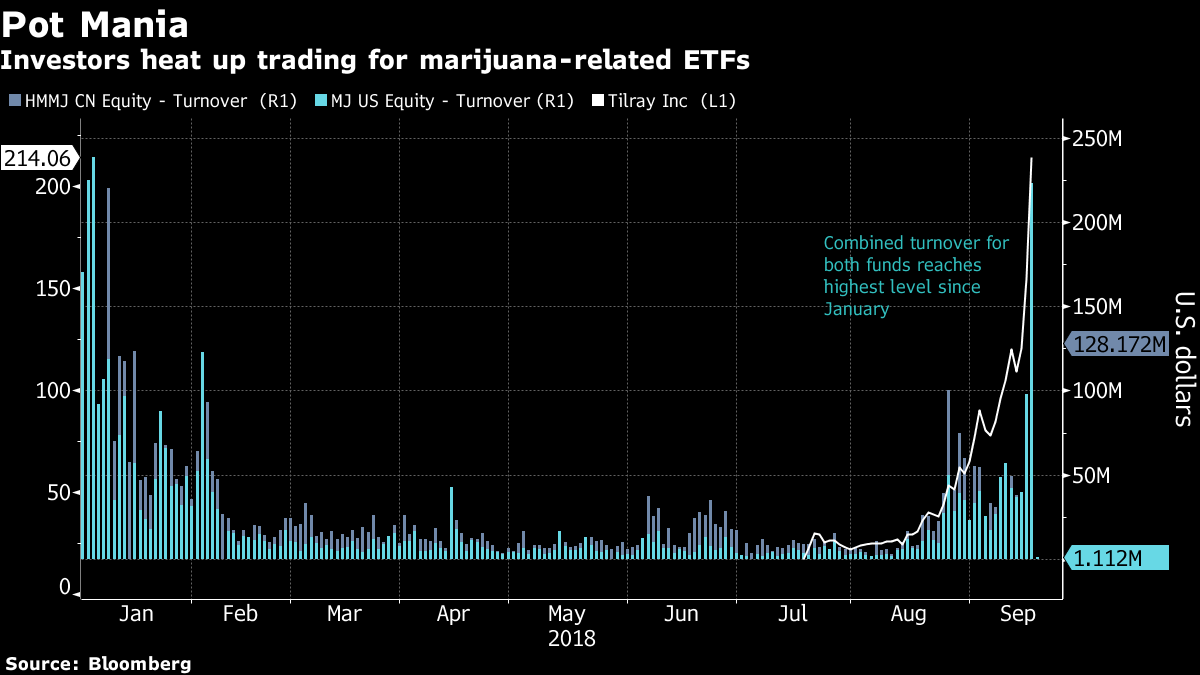

As Tilray took one of the wildest rides in the nascent sector’s history Wednesday, investors pulled the most cash since January from HMMJ. The Canadian-listed fund holds pot stocks that trade in the North American Marijuana Index -- which didn’t include Tilray at the time.

Investors yanked US$13.4 million from HMMJ and traded US$128 million worth of its shares Wednesday, the largest day by volume since January and more than five times the average daily turnover for the past year. There is now a two-week negative correlation between the daily change in Tilray and HMMJ.

The biggest U.S. listed marijuana-related ETF, the ETFMG Alternative Harvest ETF, or MJ, saw a surge in volume Wednesday, with trading of US$223 million. That’s close to 14 times the average daily turnover for the past year. Tilray is MJ’s third largest holding, making up over 9.2 per cent of the fund’s weighting. Flow data for the ETF isn’t available because the figures are delayed by one day. MJ rose more than 4 per cent Thursday.

Even without Tilray, the allure of these funds is clear. Pot-stock mania has been a boon for the companies in HMMJ, with 13 of the 49 up at least 70 per cent this year. Canada’s premier cannabis ETF had taken in US$295 million in inflows since the start of 2018 as its price soared 32 per cent.

Namaste Technologies Inc. announced its inclusion in HMMJ’s holdings Thursday, calling it a “significant milestone” as it tries to establish itself as a leader in cannabis-focused e-commerce technology, according to a press release.

Cannabis Canada is BNN Bloomberg’s in-depth series exploring the stunning formation of the entirely new – and controversial – Canadian recreational marijuana industry. Read more from the special series here and subscribe to our Cannabis Canada newsletter to have the latest marijuana news delivered directly to your inbox every day.

With files from BNN Bloomberg