Jun 11, 2018

HSBC's New Chief Outlines Plan to Spend $17 Billion by 2020

, Bloomberg News

(Bloomberg) -- HSBC Holdings Plc Chief Executive Officer John Flint said the bank plans to pour as much as $17 billion to expand in key Asian markets and improve technology, in his first wide-ranging plan since taking the helm four months ago.

Europe’s largest bank is partly investing roughly two thirds of that amount by 2020 to build its presence in Hong Kong, the Pearl River Delta, and wealth in Asia, the bank said in a statement on Monday. The rest will be spent on technology upgrades such as in cyber security. It’s also targeting a return on tangible equity of more than 11 percent by 2020.

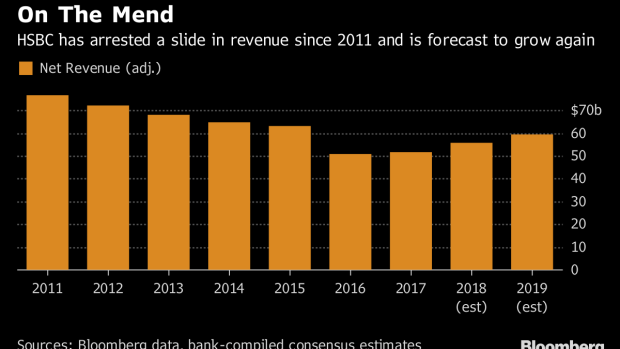

“After a period of restructuring, it is now time for HSBC to get back into growth mode,” Flint said in the statement. “In the next phase of our strategy, we will accelerate growth in areas of strength, in particular in Asia and from our international network.”

The bank’s shares were slightly lower at 727.70 pence at 9:58 a.m. in London.

Flint and Chairman Mark Tucker, who joined in October, are striving to execute a strategy that contains costs while growing revenue at the emerging markets-focused lender. HSBC -- which used to call itself the “world’s local bank” -- is now eyeing growth in China asset management and insurance, the firm said.

The CEO has also been looking at ways to expand its sub-scale wealth and asset management unit, including a potential merger with a rival, according to people familiar with the discussions earlier this year.

During Stuart Gulliver’s prior seven years as CEO, the lender closed almost 100 businesses and reduced the number of countries it operated in to 67 from 88. Even after these efforts, the bank still has 3,900 global offices, 229,000 employees. With $2.5 trillion of assets, it’s Europe’s largest bank.

(Adds HSBC comment in third paragraph.)

To contact the reporters on this story: Gavin Finch in London at gfinch@bloomberg.net;Stephen Morris in London at smorris39@bloomberg.net

To contact the editors responsible for this story: Ambereen Choudhury at achoudhury@bloomberg.net, Jon Menon

©2018 Bloomberg L.P.