Dec 10, 2018

India's Rupee, Bonds Slide as RBI Chief's Exit Roils Markets

, Bloomberg News

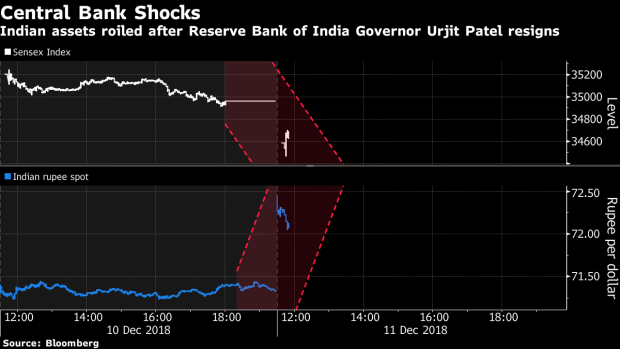

(Bloomberg) -- Indian assets declined as investors reacted to the shock exit of the central bank Governor Urjit Patel and as early trends showed the ruling Bharatiya Janata Party may face electoral losses in key states.

The rupee weakened 1.4 percent against the dollar at 9:34 a.m. in Mumbai, while yields on 10-year sovereign bonds rose 8 basis points. The S&P BSE Sensex gauge of stocks slid 1.4 percent. Patel quit Monday hours after equities closed their worst session in two months after state exit polls predicted a close fight for Prime Minister Narendra Modi in Madhya Pradesh and Chhattisgarh, and victory for Congress in Rajasthan.

Patel’s shock exit dealt investors another bout of monetary policy uncertainty when they were already bracing for an electoral test of the ruling party. An adverse result may force Modi to boost populist spending before next year’s general elections, undermining the government’s ability to stick to its fiscal deficit aim of 3.3 percent of gross domestic product.

“Governor Patel’s sudden exit intensifies market uncertainty and is negative for the Indian rupee,” Prakash Sakpal, an economist at ING Groep NV wrote in note. “The next central bank chief will be under intense pressure from the government to concede to the latter’s demands for more growth-friendly policies ahead of general elections in early 2019.”

State-owned lenders were seen selling dollars to support the rupee, likely on behalf of the central bank, Mumbai-based traders said.

Investor confidence in Indian assets had only recently bounced back, helped by a slide in oil prices and a dovish tone from the Federal Reserve. November saw the best rupee gains in nearly seven years, while local stocks saw their best month since July. Foreigners bought a net $868 million of shares in November after three months of selling, and plowed $889 million into local bonds, after avoiding the debt for most of the year.

To contact the reporter on this story: Subhadip Sircar in Mumbai at ssircar3@bloomberg.net

To contact the editors responsible for this story: Tan Hwee Ann at hatan@bloomberg.net, Ravil Shirodkar, Anand Basu

©2018 Bloomberg L.P.