Feb 2, 2016

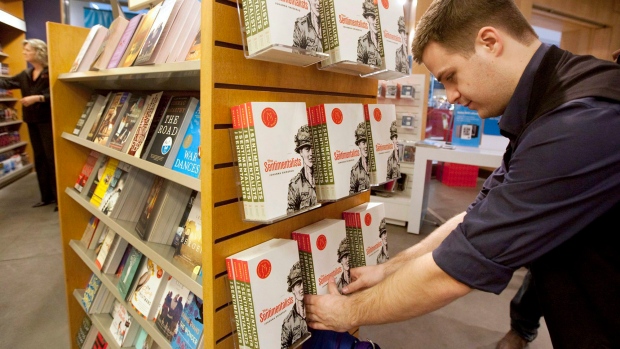

Indigo profit soars 60% as book seller shifts into general merchandise

Indigo Books and Music Inc., Canada’s largest bookstore chain, said fiscal third-quarter profit soared 60 percent as the company’s shift to general merchandise begins to pay dividends.

Net income jumped to C$52.8 million ($38 million), or C$2.02 a share, compared with C$33 million, or C$1.27, for the same period a year earlier, the company said in a statement. Revenue for the quarter ended Dec. 26 grew 13 percent to C$383.2 million.

The highest quarterly profit in three years shows Indigo is starting to see the results of a restructuring that transformed the embattled book peddler into what Chief Executive Officer Heather Reisman calls a profitable "cultural department store."

"It was a good quarter after a couple of good quarters," Reisman said. "It’s gaining some traction. So, it feels terrific."

The Toronto-based retailer posted its second-straight quarter of double-digit same store sales gains. On a comparable basis, sales jumped 16 percent for its Indigo and Chapters superstores, while Coles and Indigospirit small-format stores rose 13 percent. Online sales grew almost 18 percent.

Share Gains

The improved performance has caught the eye of investors. Indigo’s shares have gained 18 percent over the past 12 months, compared with a 14 percent decline in the Standard & Poor’s/TSX Index. It has also outperformed the S&P/TSX Consumer Discretionary Index, which has fallen 10 percent.

Indigo’s closest North American comparable, U.S. book chain Barnes and Noble Inc., has seen its own shares fall 46 percent over the same period. Barnes and Noble’s same store sales last fiscal year fell 1.9 percent while Indigo’s grew 5.7 percent, according to data compiled by Bloomberg.

Indigo began laying the groundwork for its transformation about four years ago, Reisman said. The emerging threats of e- readers and online booksellers like Amazon.com Inc. were starting to eat into revenue, and Indigo needed to diversify its revenue to offset the declines, Reisman said.

Under Reisman, who founded the company in 1996 and bought her biggest competitor, Chapters, in 2001, Indigo has managed to survive where its competitors, like Borders Group Inc., have failed.

Business Rout

"It wasn’t clear at the beginning: Was there going to be this same move in books that there was in music? Was it going to be a rout of the business or not," Reisman said.

Indigo launched its own e-reader Kobo before it was sold in 2011. The new competitors were supposed to cut sales about 20 percent based on some estimates, she said.

"The minute you take 20 percent out of any business, you’re taking away your profit," she said. "So, we said, how do we re- imagine this?"

The transformation plan called for Indigo Books to start selling everything from toys to iPads, Fitbits and dinnerware alongside the kids, tech, personal fitness, and cook books to drum up sales. Those efforts are starting to take hold.

General merchandise now accounts for about 40 percent of sales, Reisman said.

Books Rebound

While the general merchandise grew at a double-digit rate during the past quarter, book sales have also been steadily improving over the past year, and were up ’single-digits’ during the last quarter as the popularity of e-readers started to decline and the adult coloring books craze took off.

Indigo’s shares are still trading at about C$13 in Toronto, well below Reisman’s goal of returning to the C$20 range. The stock has traded below C$20 since the early 2000s, after an initial public offering at C$15 in 1996.

Reisman said that remains a goal. "We are certainly doing everything in our power," she said.