Aug 11, 2022

Indonesia’s Rupiah Seen Rising to One-Year High as Funds Return

, Bloomberg News

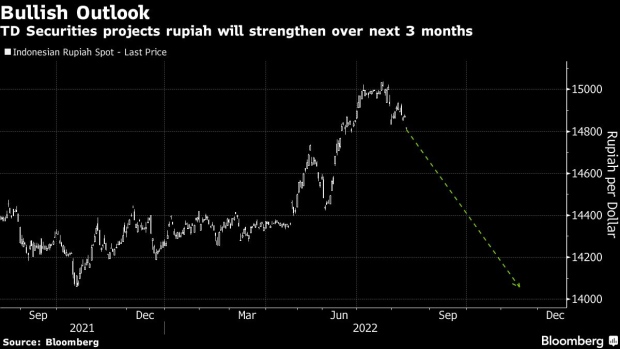

(Bloomberg) -- Indonesia’s rupiah will advance to the strongest level in almost a year as the country’s trade surplus and attractive yields lure overseas investors to local stocks and bonds, according to TD Securities.

The currency will appreciate to 14,057 per dollar in the next three months, matching the high set in October 2021, said Mitul Kotecha, head of emerging-market strategy at the company in Singapore. Attractive bond yields, rising palm oil exports to China, improving terms of trade and the prospect of interest-rate hikes should all support the currency, he said

“Indonesia is finally seeing a return of flows into both its bond and equity markets, marking a significant reversal from the previous weak trend,” Kotecha wrote in a note to clients Wednesday. The report was published before the release of the US July inflation data.

The rupiah climbed 0.5% Thursday to 14,798 per dollar as Asian currencies were boosted by the slide in the dollar after US inflation figures missed estimates. The rupiah has now extended its recovery from a two-year low of 15,038 set last month to about 1.6%.

Bank Indonesia has so far pushed back against raising rates, predicting that food-price inflation may ease in coming months. While the central bank has played for time, the Federal Reserve has been aggressively tightening, although the deceleration of US inflation last month may slow its pace of rate hikes.

Bank Indonesia is likely to start its rate-hike cycle this month and shift its stance “towards a less accommodative one,” which should also help support the rupiah, Kotecha said.

The central bank will also continue to defend the currency at the 15,000 level, while “relatively higher real policy rates than other countries in Asia also offers the IDR more protection,” he wrote.

Indonesian bonds are attractive as markets refocus on economic fundamentals following the selloff in emerging-market debt and Treasuries, JPMorgan Asset Management said last month.

©2022 Bloomberg L.P.