Oct 18, 2021

Insider Trading, Fraud Crackdown Accelerates Under Thai Watchdog

, Bloomberg News

(Bloomberg) -- Thailand is seeking to speed up criminal proceedings to crack down on insider trading, securities fraud and other illegal financial transactions, according to the nation’s top regulator.

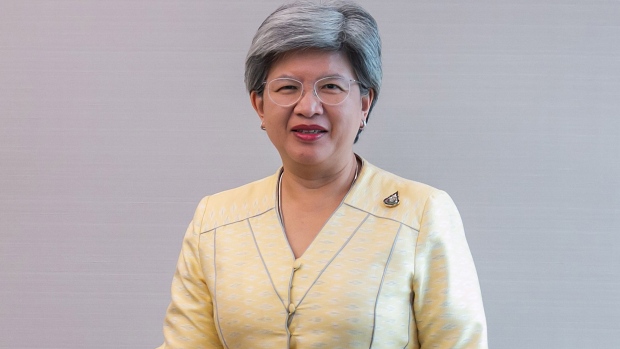

The country’s Securities & Exchange Commission plans to have more authority to investigate criminal dealings in equities, bonds and digital assets, according to secretary general Ruenvadee Suwanmongkol. The proposal would speed up charges as the current process, mostly done through the police, takes a long time, she said.

“We have better trained staff to deal with those sophisticated misconducts in the capital markets,” Ruenvadee said in an interview Friday. “Faster charges would send a strong signal to those individuals who view that the prolonged legal processes is worth taking a risk for cheating and fraud.”

Thailand has already taken steps to tighten its supervision to crack down on illegal transactions in the capital markets. Prasert Prasarttong-Osoth, founder of the nation’s biggest private hospital chain, and Pete Bodharamik, who controls a telecommunication company, were among tycoons fined for financial wrongdoings since the regulator implemented the civil penalty in 2014. In July, the commission filed a criminal complaint against Binance Holdings Ltd. with a division of the Royal Thai Police for operating a digital-asset business in the country without a license.

Still, the current punishments are insufficient to stem the increase in illegal transactions in the market, Ruenvadee said.

More Cases

The Thai SEC filed criminal complaints against 38 persons involving seven cases in the first eight months of this year, according to its website. That compares with 24 people in nine criminal cases for the whole of 2020. For civil sanctions, the regulator fined 24 people 167 million baht ($5 million) in the January to August period, compared with 10 people and 36 million baht in 2020.

The SEC plans to have more power to conduct criminal investigations for the possible violation of securities laws similar to countries such as the U.S., said Ruenvadee. Expanded authority includes the subpoena of witnesses, records, documents and information, she said.

The increased authority and enforcement is the key amendment of existing Securities & Exchange Act that has been forwarded to the finance ministry for consideration, Ruenvadee said. The ministry will discuss with other law enforcement agencies such as the Royal Thai Police and Attorney General Office before being forwarded to the Cabinet and parliament for ratification, she said.

©2021 Bloomberg L.P.