Dec 25, 2022

Investor Focus on Inflation Path, China Covid Woes: Markets Wrap

, Bloomberg News

(Bloomberg) -- Stocks made small advances while currencies were mixed in Asia on Monday amid cautious trading and reduced liquidity with many markets closed for holidays.

Benchmark equity indexes for mainland China, Japan and South Korea climbed less than 1%, with a gain of just above that for India. Other markets including Hong Kong, Singapore and Australia were shut.

Appetite for risk taking was limited, with the positive impact from recent US inflation data partly offset by concern over China’s ability to cope after abandoning its Covid Zero policy.

Amid a new wave of infections, China’s National Health Commission said it would stop publishing daily case numbers for the coronavirus, complicating the task for investors trying to assess the economic impact.

Meanwhile, data on Friday showed the Federal Reserve’s closely watched measure of inflation cooling and consumer spending stagnating. Consumers’ year-ahead inflation expectations also dropped this month to the lowest since June 2021, a survey by the University of Michigan showed.

While US equities closed higher on Friday, the S&P 500 and the tech-heavy Nasdaq 100 still suffered weekly losses.

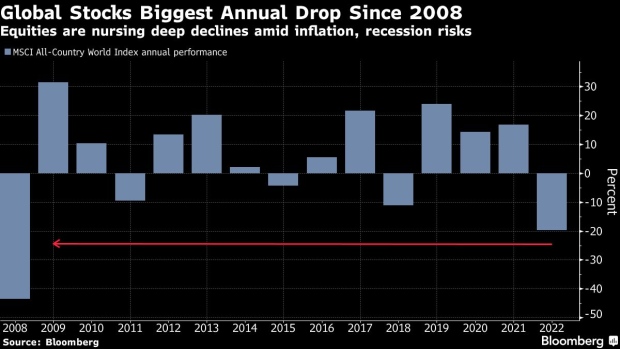

Looking across all the year for global equities, 2022 has been the worst annual performance in more than a decade.

“The Fed has been telling us they are going to tighten financial conditions until a recession or something ‘breaks’,” Stephen Innes, managing partner at SPI Asset Management, wrote in a note. “This is not a great place to own speculative assets, especially the long-duration variety telling me in times like this, cash itself is the best at the money put.”

The offshore yuan and the euro edged higher while the Australian dollar erased earlier losses. Most Group-of-10 currencies traded within narrow ranges against the greenback.

The yen strengthened versus the dollar, even after Bank of Japan Governor Haruhiko Kuroda stressed that the BOJ’s latest adjustments to yield control were not the beginning of an exit of monetary easing.

Traders are skeptical of Kuroda, with some betting that the central bank will raise interest rates next year. Yields on Japan’s 10-year government bonds jumped seven-and-a-half basis points to 0.445%, compared with the BOJ’s new ceiling of 0.5%.

There was no cash trading on Monday of Treasuries, which ended a holiday-shortened session lower on Friday. The benchmark 10-year yield climbed the most last week since early April, ending Friday around 3.75%.

Elsewhere in markets, Bitcoin was little changed below $17,000 on Monday as the crypto world continued to reel from the collapse of FTX.

In commodities, everything from oil to gold and copper rose on Friday. Oil posted a substantial weekly gain as Russia said it may cut crude production in response to the price cap imposed by the Group of Seven on its exports, highlighting risks to global supplies in the new year.

Key events this week:

- China industrial profits, Tuesday

- US wholesale inventories, Tuesday

- BOJ summary of opinions of Dec. 19-20 meeting, Wednesday

- US initial jobless claims, Thursday

- ECB publishes economic bulletin, Thursday

Some of the main moves in markets:

Stocks

- Japan’s Topix rose 0.2% as of 3:50 p.m. Tokyo time

- South Korea’s Kospi rose 0.2%

- The Shanghai Composite rose 0.6%

- India’s Nifty 50 rose 1.1%

- The S&P 500 closed 0.6% higher on Friday while the Nasdaq 100 rose 0.3%

Currencies

- The euro rose 0.1% to $1.0631

- The Japanese yen rose 0.2% to 132.68 per dollar

- The offshore yuan rose 0.2% to 6.9865 per dollar

- The Australian dollar was unchanged at $0.6721

Cryptocurrencies

- Bitcoin rose 0.2% to $16,855.79

- Ether was little changed at $1,218.58

Bonds

- Japan’s 10-year yield rose seven-and-a-half basis points to 0.445%

- The yield on 10-year Treasuries advanced seven basis points to 3.75% on Friday

Commodities

- West Texas Intermediate crude rose 2.7% to $79.56 a barrel on Friday

- Spot gold rose 0.3% to $1,798.20 an ounce on Friday

This story was produced with the assistance of Bloomberg Automation.

©2022 Bloomberg L.P.