Dec 15, 2023

Investors Baffled After Powell Turbocharges Slide in US Rates

, Bloomberg News

(Bloomberg) -- Federal Reserve Chair Jerome Powell confounded some on Wall Street this week by pouring lighter fluid over a market that was already betting on a pivot in monetary policy.

Bonds and share prices have surged since Powell on Wednesday let slip that policymakers had discussed interest-rate cuts, a signal that his remarks — whether he meant them to or not — have further loosened financial conditions.

That’s a risk to the central bank’s goal of slowing demand to rein in inflation. Even New York Fed President John Williams’ attempt to pare back market euphoria on Friday, by saying it was too early to discuss a March rate cut, fell short of undoing the week’s rally.

“I’m baffled,” Sonal Desai, chief investment officer of fixed income at Franklin Templeton said on Bloomberg Television, referring to Powell’s post-meeting comments. “It’s completely unclear why he decided it was necessary to turbocharge the move” lower in rates, especially given that he’s previously acknowledged, as rates had been rising, the market’s role in creating appropriately tighter financial conditions.

“So I would anticipate that, if the Fed wanted to show any degree of caution, it might try to rein the market exuberance back just a bit in coming weeks,” Desai added.

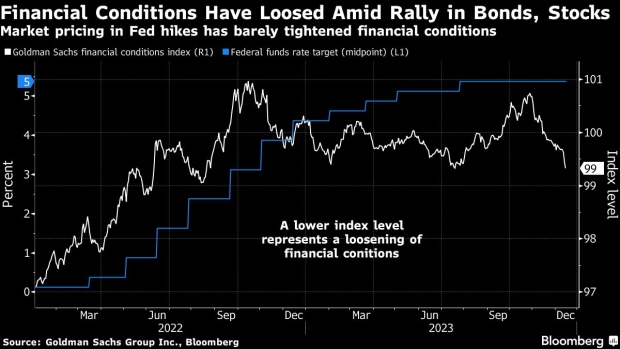

Goldman Sachs Group Inc.’s financial conditions index — a measure that incorporates variables like stock prices, credit spreads, interest rates and the exchange rate — has moved down this week and is off by over 1% since late October, when yields were Treasury yields were surging.

The Fed on Wednesday unveiled quarterly rate projections that increased the amount of rate reductions predicted next year, relative to the prior update in September. Financial markets and Wall Street banks alike have since started to prep for earlier and faster cuts next year.

Swaps contracts tied to Fed meetings indicate about 150 basis points of rate cuts in 2024, with a roughly 80% chance they begin in March. That’s even after Williams, who plays a key role in communicating central bank policy, said on CNBC that it was premature for officials to even think about a March reduction.

Read more: Fed’s Williams Says Talk of March Rate Cut Is ‘Premature’

While the two-year Treasury yield, most linked to the outlook for Fed policy, rose to a session high immediately after Williams’ comment, the move quickly faded. The yield is now little changed on the day at about 4.41%, on course to drop this week by over 30 basis points.

“Some pushback in terms of rate cut timings is likely to be forthcoming from Fed officials, but the cat is out of the bag in terms of the end of rate hikes and the next phase of the cycle being characterized by monetary easing,” Chris Iggo, chief investment officer of core investments at AXA Investment Managers, said in a note published Friday before Williams’ comments. “Market momentum will be hard to shift.”

--With assistance from Katie Greifeld and Romaine Bostick.

©2023 Bloomberg L.P.