Feb 26, 2021

Investors Can’t Get Enough of Europe’s New SPAC Kingpins

, Bloomberg News

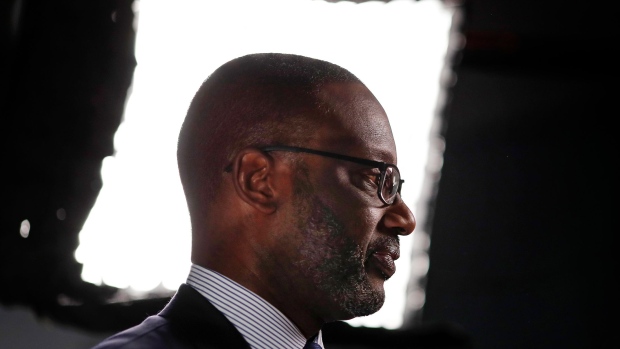

(Bloomberg) -- Investors are rushing to back Europe’s emerging SPAC stars, from ex-Credit Suisse Group AG boss Tidjane Thiam to former Deutsche Bank AG dealmaker Garth Ritchie.

Thiam raised $300 million for a special purpose acquisition company focused on deals in the financial industry, up from an initial $250 million target, according to a statement Friday. He joins a clutch of seasoned leaders in Europe that are seeing soaring demand for their blank-check firms, helped by the relative scarcity of issuers from the region looking to tap American investors.

Centricus, the London-based investment firm that helped set up the SoftBank Vision Fund, priced a $300 million offering this month for its first U.S. SPAC after boosting the deal size by 20%. The blank-check company, led by former Deutsche Bank investment banking head Ritchie, eventually brought in a total of $345 million after an over-allotment option was also exercised.

While more European sponsors are lining up to join the blank-check boom on U.S. exchanges, they still remain a small fraction of the overall market, lending them an air of exclusivity. Nearly two hundred blank-check companies have completed U.S. listings this year, raising a combined $60 billion, according to data compiled by Bloomberg. That’s already more than 70% of last year’s record fundraising tally.

Europe is currently “a less crowded arena” for deals, said Saadi Soudavar, Deutsche Bank’s co-head of equity capital markets for Europe, the Middle East and Africa. Several more SPACs focused on the region are set to list in the coming months, he said by phone Friday.

“We are seeing a robust pipeline building,” said Soudavar, whose bank was one of the arrangers on Thiam’s blank-check IPO. “Part of the differentiation that we’re seeing at the moment in the pipeline is an increase in SPACs looking at EMEA targets.”

In the latest sign of the feverish demand, Russian telecom veteran Ivan Tavrin attracted more than $6 billion of investor orders for his latest pair of blank-check companies, people with knowledge of the matter said. That’s more than 13 times the combined amount the former MegaFon PJSC head was seeking for the two firms, which started trading in New York last week. A representative said the deals saw strong demand, declining to comment further.

In December, former Barclays Plc banker Makram Azar boosted the size of his blank-check IPO to raise $300 million. He’s now scouting for gems among the dozens of European tech and fintech unicorns. Avanti Acquisition Corp., backed by Egyptian billionaire Nassef Sawiris and French entrepreneur Ian Gallienne, also upsized its October IPO. It ended up raising $600 million to for a potential acquisition to target family-owned companies in the region.

The rush of capital into these offerings is a positive sign for some upcoming deals. Oliver Samwer, the co-founder of German startup incubator Rocket Internet SE, filed this month for a $250 million SPAC targeting technology deals outside the U.S.

(Updates with banker quote from fifth paragraph)

©2021 Bloomberg L.P.