Oct 14, 2021

IPOs Prove Hardier Than Stake Sales in Europe’s Volatile Market

, Bloomberg News

(Bloomberg) --

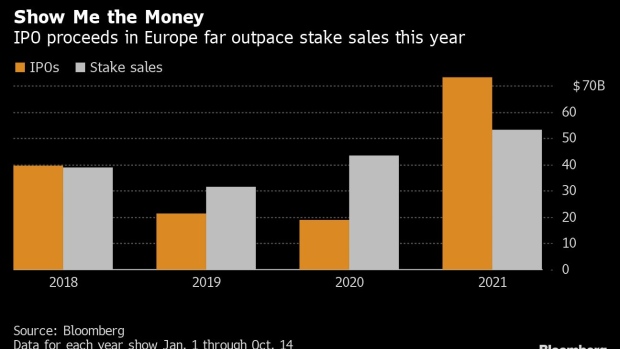

Initial public offerings in Europe are outpacing stake sales for the first time since 2018, as new listings keep defying the recent market volatility that has deterred large holders from offering stock.

IPOs have raised more than $73 billion on European exchanges this year, compared with the $53 billion worth of stake sales, according to data compiled by Bloomberg.

Companies have rushed to go public throughout this year, but stake sales have been more patchy. A rally in European equities drove several large holders to take profits in May and in early September, but now such offerings have paused amid increased market risks.

“Obviously, weeks like we had at the end of September and early October, where most trading screens were red, don’t give much comfort to launch a block,” said Fabian De Smet, head of Berenberg’s investment bank in continental Europe.

This is now a buyer’s market for both IPOs and secondary selldowns, he said. “Vendors might just have to swallow a bigger discount and leave a bit more on the table for investors.”

To be sure, Europe’s listings boom is showing its own cracks, with Dutch consumer electronics retailer Coolblue on Wednesday adding to a growing pile of pulled deals. And many of the past year’s most popular IPO stocks are trading below their issue price, caught up in a rotation away from high-growth assets.

Read More: For Every Pulled IPO, Two New Deals Hit Europe’s Crowded Market

Still, at least 13 new IPOs were announced across Europe over the past seven days alone. On Thursday, industrial-repair kits maker Rubix Group and automotive sales technology startup MotorK kicked off listings.

“The relative attractiveness of valuations in listed markets versus other exit options such as M&A” keeps driving the IPO market, said Francois-Olivier Mercier, UBS Group AG’s head of equity capital markets syndicate for Europe, the Middle East and Africa.

©2021 Bloomberg L.P.