Feb 28, 2024

It’s Impossible to Call the Top in Stocks, Goldman’s Rubner Says

, Bloomberg News

(Bloomberg) -- It has proved impossible to call the peak in this euphoric US stock market, says Goldman Sachs Group Inc.’s tactical specialist Scott Rubner.

Retail traders have been lured into this rally just as a Goldilocks scenario — where the economy is running neither too hot nor too cold — has been playing out, prompting analysts quickly to upgrade their year-end targets, Rubner wrote in a note to clients on Wednesday. March is now a “fuller house” and the rally is “tired,” however there is no catalyst for a potential selloff, he said.

Beyond the little blip this week, US stocks have been on a tear since late last year. The record-setting run has been powered by Big Tech stocks led by AI poster child Nvidia Corp., which Rubner reckoned “the most important stock on planet earth” ahead of its blockbuster earnings report. Yet, there’s hardly any sign of a serious pullback.

“‘The Return of the YOLO’ was not on my February bingo card,” Rubner said, referring to his previous call for a poor second half of February for US equities based on seasonal patterns. YOLO is the abbreviation for “you only live once” used in certain Reddit forums when retail traders make risky bets in stock markets.

“I need to wake up every morning to see what stock can rally 50% by Friday.”

The rush is such that Goldman’s traders earlier this week pointed to data that underscored the market’s confidence in tech stocks. The put-call skew, often used as a measure of investor fear, has moved lower, and retail trading activity in Nvidia was in the 99.96th percentile for the week.

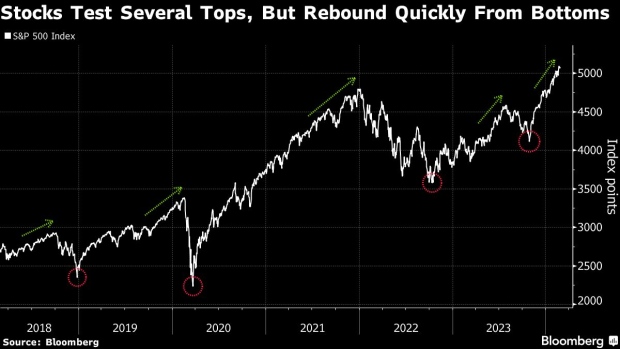

Bank of America Corp. strategist Michael Hartnett has also flagged that stocks tend to test several tops before a meaningful pullback. Conversely, the rebound from a bottom tends to be relatively quick “because human nature means ‘fear’ is so much more easier to reverse than ‘greed,’” Hartnett wrote in a note this month.

--With assistance from Sagarika Jaisinghani.

©2024 Bloomberg L.P.