Jan 11, 2019

It’s Plug-Ins Vs. Pickups in Newest Culture Crash

, Bloomberg News

(Bloomberg Opinion) -- 2018 is shaping up to be a record year for electric vehicles. My Bloomberg NEF colleagues expect 1.9 million EVs will have been sold last year, up from 1.1 million the year before, with the bulk of those sales in Asia. Overall, China’s new passenger vehicle sales were in significant decline for the first time in more than 20 years.

Rapid growth requires the infrastructure to keep those electric vehicles charging on road trips, at offices or any time their owners aren’t plugging in at home. That infrastructure is being built in major auto markets — and some new behaviors are cropping up, too, as electric vehicle charging outlets are being built at retailers, apartment complexes and especially at gas stations.

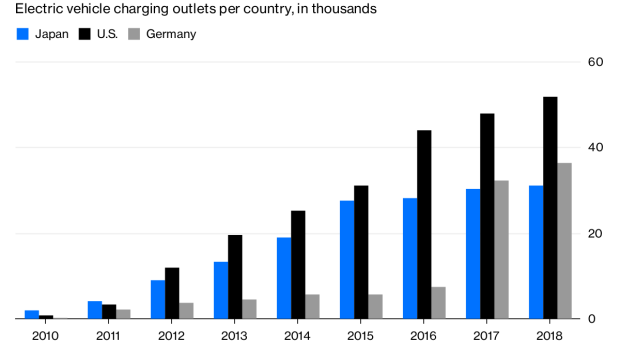

There are currently about 50,000 fast-charging outlets in the U.S., and Germany and Japan have 30,000 to 40,000 each. However, as Bloomberg News’s Marie Mawad found out during her recent drive from Paris to Mannheim, Germany, there are still not enough charging outlets to set a road-tripping EV driver’s mind at ease.

China has … a few more. And for good reason: Very few drivers in China have personal garages in which to slow-charge overnight.

Meanwhile, by the end of last year, there were reports of U.S. drivers being “ICEd out”: drivers of internal combustion engine cars deliberately occupying dedicated charging spots, preventing EV drivers from using them. Besides being deliberate and hostile, it’s not an exaggeration to call such behavior the result of a culture clash between the environmentally minded and coal-rolling enthusiasts. More plainly, perhaps, it is new versus old.

That raises a few questions for me. First, where else will such behavior begin to happen?

Even if it’s just at gas stations, there are plenty of those. The U.S. has more than 100,000 of them.

The number of filling stations is stable in the U.K., too, but only after a dramatic decline over the past 50 years.

Second, how long might this behavior last? Are we in for decades of EV drivers being ICEd out at filling stations that have only a few chargers on the lot?

These hybrid filling/charging stations are likely a temporary phenomenon. With more electric vehicles on the road, companies will eventually be able to offer tailored infrastructure specific to electric vehicles. In other words, if you drive an electric vehicle, only another EV driver will be able to inconvenience you.

Electric vehicle drivers also will be treated to, or possibly demand, a different set of experiences to fill the time required to charge, such as shopping and children’s activities, in dedicated spots that are quieter than gas stations — and fume-free. If there’s a culture clash between EV drivers and those who prefer internal combustion engines, it might not last long as they spend less and less time in proximity.

I’m not certain, either, that the big players in today’s roadside landscape will have the same dominance in building, owning and operating electric vehicle infrastructure. Volkswagen AG, for instance, announced that it will create an entirely new company, Elli, that will sustainably provide energy and charging services. And while integrated oil companies like BP Plc and Total SA have acquired charging networks, I think they will find some challengers in potentially unexpected places.

The good thing, from the oil majors’ perspective, is that electric vehicle chargers are a network of endpoints, so to speak, that can be incorporated into an existing asset base. But by the same token, if this is a network that taps into something any company has access to (in this instance, the electricity grid), then the competitive advantage isn’t in the logistics of fuel delivery, owning sites or possessing the hydrocarbons.

The competitive advantage will lie in what other things a company can offer to drivers who have a half-hour or more to spend with a company. It could be still be necessities, but it could also be luxury goods, fine food or even experiences. Whatever it might be, it probably won’t involve being ICEd out.

Weekend reading

- Natural disasters caused $160 billion in damages in 2018. Half of those damages were insured.

- U.S. carbon emissions increased last year thanks to two overlooked sectors: industrial manufacturing and buildings.

- Holy Cross Energy, a rural electric cooperative in New Mexico and Colorado, will hit its 70 percent renewable electricity target nine years early.

- In 2015, only 15 percent of U.S. adults had used ride-hailing services. By 2018, 36 percent had.

- Household vehicle ownership is increasing faster than urban population growth in the eight U.S. cities with the highest use of ride-hailing.

- Of the top 15 cars in the U.S. that original owners keep for 15 or more years, 10 are from Toyota Motor Corp., four are from Honda Motor Co. Ltd. and one is from Subaru Corp.

- The rise and fall of China’s bike-sharing empires.

- Micromobility is a big word for a small idea.

- Ford Motor Co. is shutting down its Chariot shuttle service, which it had acquired for a reported $65 million.

- General Motors Co. expects to grow its profits in 2019, and says that “Cadillac will be GM’s lead electric vehicle brand and will introduce the first model from the company’s all-new battery electric vehicle architecture.”

- Smartphones are a good example of a broader historical pattern: Technologies usually arrive in pairs — a strong form and a weak form.

- Richard Branson says the next big industry ripe for disruption is air conditioning.

Get Sparklines delivered to your inbox. Sign up here. And subscribe to Bloomberg All Access and get much, much more. You’ll receive our unmatched global news coverage and two in-depth daily newsletters, the Bloomberg Open and the Bloomberg Close.

To contact the author of this story: Nathaniel Bullard at nbullard@bloomberg.net

To contact the editor responsible for this story: Brooke Sample at bsample1@bloomberg.net

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Nathaniel Bullard is a BloombergNEF energy analyst, covering technology and business model innovation and system-wide resource transitions.

©2019 Bloomberg L.P.