Jun 6, 2023

JAL Returns to Transition Bond Market as Sales Inch Higher

, Bloomberg News

(Bloomberg) -- Japan Airlines Co. is planning to return to the transition bond market, seeking cheaper funds as one of the few carriers issuing the debt in a market dominated by utilities.

The Tokyo-based airline has hired banks to sell about 10 billion yen ($72 million) of 10-year transition notes next week, according to underwriter Daiwa Securities Co. JAL last year undertook its debut sale of the debt designed to help companies in heavy-emitting industries become more energy efficient and reduce emissions.

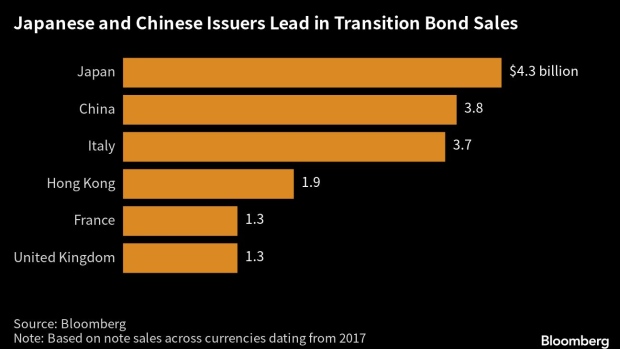

Transition bond deals have increased 47% so far this year to $2.1 billion after Air France-KLM priced the biggest such deal of 2023, in a market that has been led by Japanese and Chinese issuers. A lack of clear standards for sales of such debt, compared especially with green finance guidelines in Europe, has limited sales of transition bonds globally.

Issuance is a fraction of that in the green bond market, where sales climbed 23% to $265 billion so far this year, Bloomberg-compiled data show.

Japan and the rest of Asia have pushed hard to increase transition financing including loans as a way to pay for cleaning up its industries. Japan’s Chugoku Electric Power Co., Tohoku Electric Power Co. and Osaka Gas Co. have all sold transition notes in yen this year.

JAL’s first transition bond has dropped about 0.48 yen since March last year from the 100 yen par price, compared with a 1.3 yen decline in corporate debt in the Japanese currency during the period, according to a Bloomberg index.

(Adds chart.)

©2023 Bloomberg L.P.