Dec 20, 2022

Japan Blindsides Traders to Echo Christmas Day Surprise of 1989

, Bloomberg News

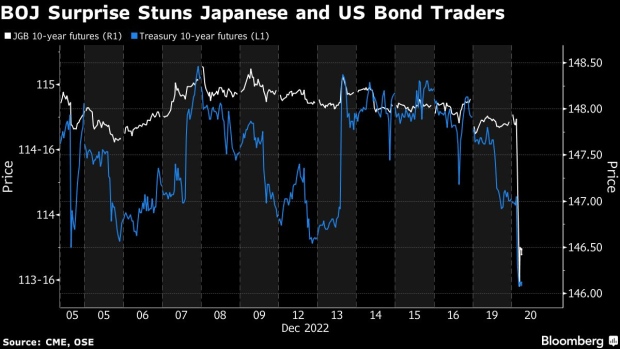

(Bloomberg) -- The Bank of Japan’s latest policy shock is cementing the central bank’s reputation for using the element of surprise to achieve its strategic goals.

BOJ Governor Haruhiko Kuroda’s decision to widen the trading band on 10-year bond yields triggered a jump in the yen and roiled global markets. The change blindsided investors, just like Kuroda’s move to boost bond purchases in 2014 and Japan’s festive season rate hike in 1989.

“It was about this time, 33 years ago when, unhappy with dollar-yen, the BOJ hiked 25 basis points to 4.5% on Christmas Day,” Martin Whetton, head of fixed income and currency strategy at Commonwealth Bank of Australia, wrote in a note.

The breadth and size of the market reaction underscores the BOJ’s record for surprises at a time when major peers such as those in the US have been seeking to move away from forward guidance. Kuroda’s career has been replete with sudden shocks and long pauses, indicating he may well judge that to be a more effective path.

“An interesting feature of the Bank of Japan is unlike other central banks, they seem to like to surprise the markets,” Omar Slim, a money manager at PineBridge Investments in Singapore, said in an interview last week. “It is a monetary policy tool for them in the sense it’s a very different philosophy. For them, this is how we have an impact as opposed to other central banks which is to telegraph.”

Speculation of some sort of change had been bubbling in markets on Monday, after Kyodo reported that the government was planning to revise an inflation accord with the BOJ. Still, it was just weeks ago that Kuroda had insisted that Japan’s inflation — though on the rise — fell well short of the sustainable increase that could justify a policy shift.

“We view this decision as a major surprise, as we had expected any widening of the tolerable band to be made under the new BOJ leadership from spring next year,” Naohiko Baba, Japan’s chief economist at Goldman Sachs Group Inc. wrote in a note.

The BOJ chief is set to leave office in April when his second term expires, with markets expected to weigh the success of the decades-long experiment with rock-bottom interest rates. The policy tweak may continue to roil markets in the coming days, although some analysts caution that the move may not be the pivot that traders say it is.

All 47 economists surveyed by Bloomberg had forecast no change in policy at Tuesday’s meeting.

Up until now, the biggest shock delivered in recent times by the BOJ was probably the Oct. 31, 2014 decision to expand its easing program. That move was predicted by three of the 32 economists surveyed at the time.

--With assistance from James Hirai.

(Adds comment in seventh paragraph and updates chart.)

©2022 Bloomberg L.P.