Apr 2, 2023

Japan’s Manufacturer Sentiment Worsens to Two-Year Low

, Bloomberg News

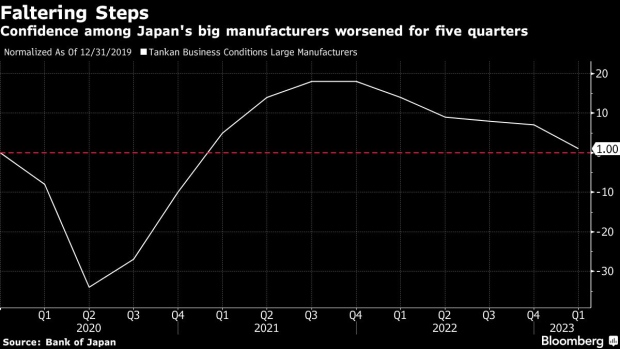

(Bloomberg) -- Confidence among Japan’s large manufacturers deteriorated to a two-year low, supporting views that incoming central bank governor Kazuo Ueda will maintain an ultra-easy monetary policy for a while longer.

An index of sentiment among the country’s biggest manufacturers declined to 1 in March from 7, according to the Bank of Japan’s quarterly Tankan report released Monday. The reading worsened for five straight quarters and fell below an economists’ forecast of 3.

The business mood among large non-manufacturers slightly improved to 20 from 19, marking the highest in a pandemic recovery. A positive number means optimists outnumber pessimists.

The continued deterioration in manufacturers’ confidence reflects concerns over a possible global slowdown as the world’s central banks keep raising interest rates, suggesting a need for the BOJ to keep supporting the economy. The companies are also taking a gloomier view of the economic climate for the coming months.

“The BOJ will recognize that the economy is still in the process of recovery,” said Kenta Domoto, a consultant at Mitsubishi Research Institute. “Rather than rushing to revise policy, it will continue to scrutinize data to determine whether economic conditions are such that policy revisions are feasible.”

Meanwhile, non-manufacturers were more optimistic about business conditions over the past few months, after the country reopened its borders to foreign tourists in October. The number of international visitors to Japan jumped to 1.48 million in February, about 90 times the same month last year, which likely boosted sales of inbound products.

What Bloomberg Economics Says...

“If anything, the survey will add to the case for the BOJ to keep up stimulus. Kazuo Ueda will take over as governor in early April. We see him keeping the yield-curve control settings steady this year”

— Yuki Masujima, economist

Click here to read the full report.

A further easing of virus-related restrictions also contributed to revitalizing the service sector, including restaurants and hotels. Japan scrapped mask-wearing guidelines last month, and more restrictions will be relaxed in May when Covid is due to be classified in the same category as seasonal flu.

Read more: Japan Service Activity Marks Strongest Since 2013 on Tourism (1)

Stronger inflation, however, is also a major concern for the service industry going forward. Inflation reached a 40-year high in January before Prime Minister Fumio Kishida’s stimulus package began to help lower energy bills. Soaring procurement costs weigh on the profitability of otherwise recovering non-manufacturers.

The Tankan report showed companies expect an annual inflation rate of 2.1% in five years’ time, slightly accelerating from 2.0% in the previous survey. In a year, they expect prices to climb 2.8%.

More details from the report:

- An index of the outlook for large manufacturers worsened 3 from 6, while the gauge for large non-manufacturers rose to 15 from 11

- A gauge for all small firms declined to 3 from 4; the outlook improved to 0 from -2

Outgoing Governor Haruhiko Kuroda has repeatedly said that monetary easing is needed to sustain the country’s economy, and Ueda, who takes office over the weekend, is seen continuing in that direction for now. The new governor is set to preside over his first policy-setting meeting later this month.

“Downward pressure will continue for some time with a lag” even after the global tightening cycle is over, said MRI’s Domoto. “It is unlikely that the effects of the global economic slowdown will bottom out until around the second half of this year.”

--With assistance from Toru Fujioka.

(Updates with more details from the report, economist comments)

©2023 Bloomberg L.P.