Jan 5, 2023

Japan’s Real Wages Fall Most Since 2014 in Challenge for BOJ

, Bloomberg News

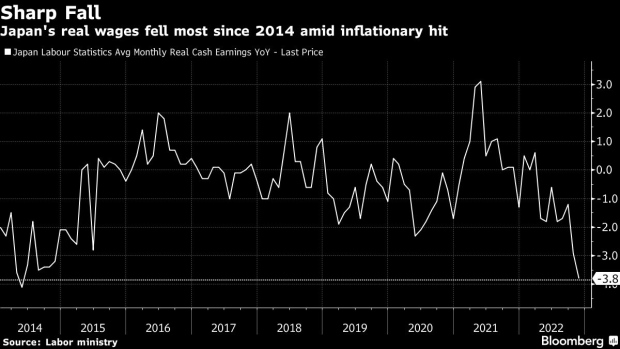

(Bloomberg) -- Japanese workers’ real wages fell by the most in eight years, suggesting that there’s still some way to go before the central bank can achieve its wage-growth accompanied price goal.

Real cash earnings for Japan’s workers dropped 3.8% from a year earlier in November, declining for the eighth straight month, the labor ministry reported Friday. Economists had predicted a 2.8% slump.

The decline was led by a sharp drop in bonus payments, as the gain in basic salaries remained relatively stable.

The prolonged fall lends some credence to the view that Bank of Japan Governor Haruhiko Kuroda won’t take further action for the remainder of his term. Kuroda has repeatedly stressed the bank will not move away from monetary easing until wages and prices rise stably, and insisted that December’s surprise move was purely to address market function and was not a step toward policy normalization.

Given that the November drop was largely the result of a dip in one-time bonus payments, “it would be premature to conclude that wages are significantly declining based on this month’s results alone,” said Uichiro Nozaki, an economist at Nomura Securities Co. “The focus is on whether Japan’s wage trend will change after this year’s spring wage negotiations.”

Nominal wages rose 0.5% from the previous year in November, still weaker than the level Kuroda has said is necessary for sustainable price growth. The governor earlier indicated that Japan needs paychecks to grow at around 3% to achieve the BOJ’s 2% price goal.

Core inflation in Japan recently hit a four-decade high, making it increasingly difficult for wages to keep up. Price hikes are expected to continue this year, putting more downward pressure on consumption. November retail sales data already showed some inflationary impact, with consumer spending unexpectedly falling despite a rebound in demand from foreign tourists.

What Bloomberg Economics Says...

“The pay data will be troublesome for the BOJ. The central bank in December took some small steps to prepare the way for an eventual exit from stimulus, widened the range of its yield curve settings to give bond yields more room to move. Signs that the current inflation isn’t sustainable make any moves in this direction more difficult.”

— Yuki Masujima, economist

For the full report, click here

Attention is being paid to the outcome of the upcoming spring wage negotiations, which will become clear a few weeks before Kuroda concludes his decade-long stint in April. The wage trajectory is expected to impact the BOJ’s policy direction beyond Kuroda’s term.

Economists see payrolls going up to some extent, with a number of Japanese companies, including Canon Inc. and Kirin Holdings, reportedly planning to raise their base salaries.

Prime Minister Fumio Kishida repeated his call for firms to increase pay fast enough to remain ahead of inflation on Thursday, speaking to a gathering of senior business executives.

The government is also keeping a close eye on wage trends. A 71.6 trillion yen ($537 billion) economic stimulus package unveiled by Kishida last year included incentives for businesses to increase wages, in addition to anti-inflationary measures.

(Updates with more details from the report, economist comments)

©2023 Bloomberg L.P.