Dec 20, 2022

Japan Two-Year Yield Rises Above Zero for First Time Since 2015

, Bloomberg News

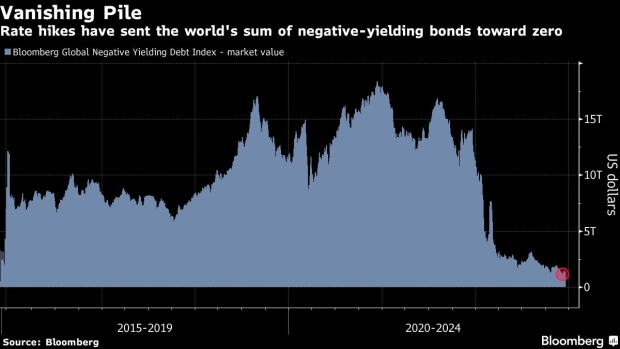

(Bloomberg) -- Negative yields R.I.P.

The global pile of bonds with sub-zero yields shrank on Wednesday as Japan’s two-year sovereign yield briefly climbed into positive territory for the first time since 2015. The worldwide stock of negative-yielding debt stood at about $686 billion on Tuesday, down from a peak of $18.4 trillion reached two years ago.

The jump in Japan’s yields was triggered by the central bank’s policy adjustment, a move which may signal that the world’s last uber-dovish monetary authority is inching toward normalization. The European Central Bank exited its negative-rate policy in July, followed by its counterparts in Switzerland and Denmark in September.

“What we are looking at is a reexamination of the efficacy of ultra loose monetary policy, and the BOJ is the last skittle to fall in all of this,” said Stephen Miller, a former head of fixed income at BlackRock Inc. in Australia, who’s now at GSFM Pty. “I hope this is the end for negative rates because it might mean we’re going to stop relying on central banks to do everything. We now know that negative rates don’t work, full stop.”

Japan’s two-year yields rose to a session high of 0.01% Wednesday, before falling back to minus 0.015%, according to Japan Bond Trading Co. data. All other benchmark tenors in the nation have positive yields.

In the US, Treasury yields are lower across the curve on Wednesday, with the 10-year rate trading as low as 3.62%. The inversion of the Treasury yield curve lessened, although yields on longer-term notes are still far below those on shorter debt. The premium two-year yields offer over 10-year levels is around 53 basis points.

Japan’s move comes amid growing discourse about the need for continued central bank stimulus after Japan’s inflation hit its fastest clip in 40 years in October. The debate took on added urgency earlier this year when a slide in the yen to a three-decade low drove up the cost of living for consumers.

“The current growth and inflation settings globally no longer justify keeping sub-zero interest rates,” said Winson Phoon, head of fixed income research at Maybank Securities Pte in Singapore. “Negative yielding debts are set to disappear as global major central banks are withdrawing from the negative interest rate regime one by one, with the BOJ probably the last man standing.”

The rise in Japan’s yields mirrors a similar move in developed markets. The rate on two-year German bonds, for example, has touched 2.51% from a low of minus 0.79% reached in March.

Still, the struggle by the two-year Japan yield to remain above zero suggests that the BOJ may keep defending its yield curve control policy for now.

The central bank announced unscheduled purchases of ¥200 billion ($1.5 billion) yen of three-to-10 year debt after the 10-year yield rose toward its 0.5% ceiling. That’s on top of the daily offer to buy an unlimited amount of 10-year notes at a fixed yield of 0.50%.

--With assistance from Hidenori Yamanaka and Alexandra Harris.

(Updates US Treasury yields in sixth paragraph.)

©2022 Bloomberg L.P.