Feb 7, 2023

Japanese Sell Record Amount of Foreign Bonds as Hedge Costs Rise

, Bloomberg News

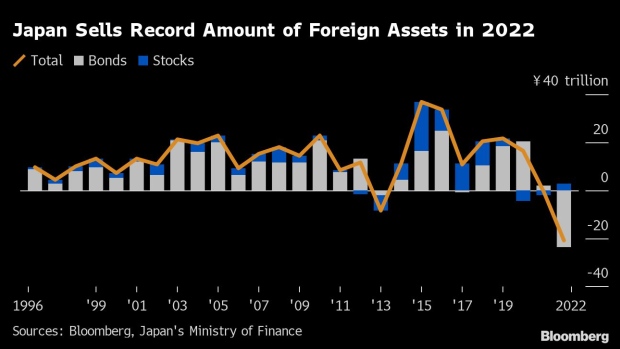

(Bloomberg) -- Japanese investors offloaded a record amount of overseas debt last year as hedging costs rose and speculation the nation’s central bank would normalize policy fueled bets on higher local yields.

Money managers in the Asian nation cut holdings of foreign fixed-income securities by ¥23.8 trillion ($181 billion) over the period, according to balance-of-payments data published by the Ministry of Finance on Wednesday. That was an all-time high in the data that starts in 1996.

The cost for Japanese investors to hedge against volatility in foreign currencies soared last year as central banks around the world raised interest rates to combat inflation. Growing speculation the Bank of Japan would wind back its super-easy monetary policy exerted upward pressures on local yields, boosting their allure over foreign debt elsewhere.

“We would think that the Japanese continue to invest in their local market, bolstered by higher yields and a steep slope of the curve,” Martin Whetton, head of fixed income and currency strategy at Commonwealth Bank of Australia in Sydney, wrote in a research note. “While global bonds are looking tasty in absolute terms, they are terrible when looked at on a like for like, or FX-hedged basis.”

Japanese funds sold a net ¥15.7 trillion of US bonds and ¥1.8 trillion of French securities, both all-time highs, according to the MOF data. UK debt bucked the trend, seeing net purchases of ¥232.6 billion. While trimming their debt holdings, the funds turned net buyers of overseas equities, scooping up ¥2.97 trillion, the MOF data show.

“Selling was limited in non-core Italy and Spain, where carry is relatively elevated, suggesting sales were concentrated in the core economies, where FX-hedged foreign bond yields deteriorated,” wrote Barclays strategists including Shinichiro Kadota in a note to clients.

Some strategists have warned that the retreat of Japanese buyers could weigh on euro-area issuers such as France, adding to headwinds for the region’s bonds, including larger issuance programs to fund expansive fiscal policies and the start of the European Central Bank’s quantitative tightening program from March.

US Treasury 10-year notes currently yield about minus 134 basis points for Japanese investors on a currency-hedged basis, compared with about positive 0.5% for similar-maturity local debt, according to data compiled by Bloomberg.

“The investment environment for Japanese investors was tough in 2022 and this year looks no better,” said Tsuyoshi Ueno, a senior economist at NLI Research Institute in Tokyo. “Hedge costs are likely to stay high. Non-hedged investment is exposed to a risk of yen strength.”

The BOJ unexpectedly doubled its cap for 10-year yields to 0.5% in December, citing a desire to improve the functioning of the market. Since then, speculation has intensified that policy makers will further adjust policy, including a removal of their yield-curve-control program.

Japanese investors bought a net ¥30.3 trillion of local government bonds last year, the most in a decade, according to separate data published by the Japan Securities Dealers Association last month.

--With assistance from Matthew Burgess.

(Adds details on Europe in 6th, 7th paragraph. Updates pricing.)

©2023 Bloomberg L.P.