Oct 9, 2023

JPMorgan, Citi Prepare for Fed’s Higher-For-Longer Approach: US Earnings Week Ahead

, Bloomberg News

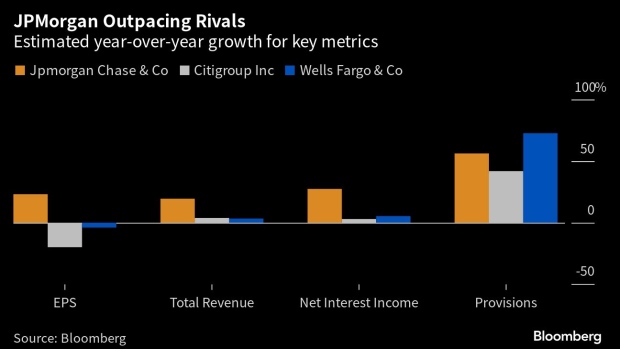

(Bloomberg) -- JPMorgan Chase & Co. is expected to have outperformed Citigroup Inc. and Wells Fargo & Co. in profitability when the three banks report quarterly earnings this week, though all lenders face challenges from a slow economy and high interest rates.

JPMorgan and its peers are seen bolstering loan-loss provisions further amid the lingering possibility that the US could slip into recession as early as this year. A “blowout” jobs report last week raised the likelihood the Federal Reserve will hike interest rates again, further constraining net interest income growth and highlighting the need to lower business costs.

Quarterly reports from PepsiCo Inc., Walgreens Boots Alliance Inc. and Domino’s Pizza Inc. will underscore the dwindling spending power of American consumers, who now hold less cash in hand than they did before the pandemic.

Monday: No earnings of note.

Tuesday: Pepsi (PEP US) earnings are seen rising 9.4%, slowing after two quarters of double-digit gains. Concerns that cost-conscious customers will switch to cheaper brands may be overstated, Goldman Sachs said, noting that PepsiCo enjoys a “favorable geographic footprint” over rivals. However, BI said unfavorable foreign-exchange rates likely crimped quarterly revenue growth. Pepsi, which has the capacity to take on $10 billion of debt without hurting its credit profile, could be looking to further grow its portfolio of snack brands; the company had shown interest in buying Hostess Brands, which was eventually sold to J.M. Smucker.

Wednesday: No earnings of note.

Thursday: Walgreens Boots’ (WBA US) adjusted earnings per share likely shrank 14% in the quarter, with Jefferies analysts expecting continued pressure on the profitability of its US retail pharmacy segment, the company’s largest money maker. Operational issues with VillageMD, a clinic operator in which Walgreens has a controlling stake, also likely weighed on performance. Analysts are calling Walgreen’s 2024 and 2025 guidance into question amid the drugstore chain’s recent C-suite shakeout.

- Delta Air Lines (DAL US) has seen estimates for its third-quarter adjusted earnings revised downwards as higher fuel and labor costs bite. The carrier’s four-year contract with its pilots, signed in March, will further erode margins at a time when slowing domestic demand is also squeezing passenger yield, BI said.

- Domino’s Pizza’s (DPZ US) domestic same-store sales growth was flat in the quarter from a year ago, dragged down by fewer delivery orders, BI said. A revamped loyalty program and a new partnership with Uber Eats could help in the fourth quarter, though the worsening global consumer environment will continue to weigh on earnings, Barclays said.

Friday: JPMorgan (JPM US) is set to post the fastest earnings-per-share growth among major US investment banks this reporting season, according to data compiled by Bloomberg. Net interest income likely jumped 27% in the period, offsetting declines in trading revenues and investment-banking fees. The bank could beat its full-year NII guidance, defying the impact of persistently higher interest rates, said Piper Sandler. JPMorgan’s third-quarter report is due pre-market.

- Citigroup (C US) earnings likely fell 18%, while Wells Fargo’s (WFC US) are projected to decline 3.6%. Expenses and efficiencies will be under increased scrutiny in both reports, which are due before the opening bell. Rising operating costs are outpacing Citi’s revenue growth and weighing on profitability, even as the bank prepares to overhaul its organizational structure, BI said. Meanwhile, Wells Fargo has reiterated its full-year expense outlook but also has opportunities for more efficiencies, Piper Sandler said.

- PNC Financial Services (PNC US) could say more about this month’s purchase of a $17 billion portfolio of capital-commitment facilities from Signature Bank, on its third-quarter earnings call. The deal should add around 10 cents per share in the fourth quarter without materially impacting PNC’s capital ratios, RBC Capital Markets said. Earnings and revenue likely shrank in the third quarter, with net interest margin down for the first time after six straight quarters of growth.

- BlackRock’s (BLK US) adjusted earnings are projected to fall 11% from a year ago, as the firm faces challenges from slowing institutional flows and foreign-currency headwinds, Citi analysts said.

©2023 Bloomberg L.P.