Feb 21, 2024

JPMorgan’s Kolanovic Bucks Consensus by Seeing Stagflation Risks

, Bloomberg News

(Bloomberg) -- JPMorgan Chase & Co.’s Marko Kolanovic, who drew attention for his gloomy stock-market calls through last year’s rally, is raising a risk that’s mostly gone out of vogue on Wall Street: a return of 1970s-style stagflation.

The bank’s chief market strategist said a recent pickup in consumer and producer prices has cast a shadow over the economic enthusiasm that powered equity markets in recent months.

He said the recent data is likely to chip away at investors’ expectations that the economy is heading for a “Goldilocks” scenario — not expanding or contracting too much — and renew concerns about entering a period similar to the stagflation of the 1970s. Those fears raged in 2022 as inflation was surging, but they’ve largely faded now that the pace has retreated sharply and the economy has consistently defied recession forecasts.

“Investors should be open-minded that there is a scenario in which rates need to stay higher for longer, and the Fed may need to tighten financial conditions,” Kolanovic wrote Wednesday in a note to clients.

A halt in inflation’s downward trend, or price pressures broadly resurfacing “wouldn’t be a surprise” given outsized gains in equities, tight labor markets and high immigration and government spending, according to Kolanovic.

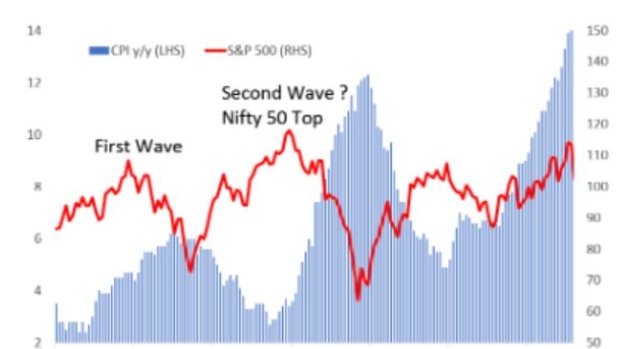

Between 1967 to 1980, stock returns were nearly flat in nominal terms as inflation came in waves, with fixed-income investments significantly outperforming. Kolanovic sees “many similarities to the current times.”

“We already had one wave of inflation, and questions started to appear whether a second wave can be avoided if policies and geopolitical developments stay on this course,” he said in Wednesday’s note. Moreover, inflation is likely to be harder to control, in his view, as stock and cryptocurrency markets add trillions of dollars in paper wealth and quantitative tightening is offset by treasury issuance.

Kolanovic has recently cut a contrarian figure on Wall Street, and his latest concerns take aim at the confidence that the Fed is poised to steer the economy to a so-called soft landing.

But his view on US equities has failed to materialize for two consecutive years: He was bullish throughout most of 2022’s rout and maintained a pessimistic outlook across last year’s big rally.

Markets have recently dialed back expectations for Fed rate cuts this year after faster-than-expected inflation readings and pushback from policymakers. Fed officials last month held interest rates steady as they nursed concerns over the risks of easing policy too prematurely.

Investor hopes of “parabolic stock markets” and “platinum-locks” — an even more optimistic version of Goldilocks — reflect excessive optimism. The strategist also disagreed with a theory that stocks can trade higher because the neutral rate of interest, or so-called R-star, is making financial conditions easier.

“This sounds to us like a stretch, and consumers who can’t afford the new mortgage rate or a car loan payment are not deciding based on theoretical changes in r-star,” he wrote.

©2024 Bloomberg L.P.