Mar 6, 2023

JPMorgan Spells Out ‘Volmageddon’ Risk on Zero-Day Option Craze

, Bloomberg News

(Bloomberg) -- JPMorgan Chase & Co. strategists are throwing fresh light on their contentious warning that the craze for zero-day options raises the risk of a market-wide “Volmageddon 2.0.”

In a new study, a 5% drop in the S&P 500 is seen snowballing another 20% in the worst-case scenario of thin trading, in the extreme event all traders offload their holdings of zero-day-to-expiration options, known as 0DTE.

The research seeks to rebut those on Wall Street who say the bank’s original alarm is overblown, after it drew a parallel between today’s boom in the derivatives contracts that mature in less than 24 hours and the volatility implosion in 2018. By JPMorgan’s estimate, daily notional volumes in these ultra-short-term options is around $1 trillion.

“The estimated market impacts from 0D option unwind exceed the original market shocks in all scenarios, highlighting the reflexive nature of the 0D options and their potential risk posed to market stability,” the team lead by Peng Cheng wrote in a note Monday.

Getting a handle on the threat posed by the rise of the fast-twitch contracts is challenged by the sheer size of the options marketplace, the short lifespans of these trades and uncertainty about who is using them. While some on the Street see the derivatives as reducing market volatility, others led by JPMorgan see them as a source of extreme turbulence.

In the latest research, Cheng and his colleagues set out to quantify the downside risk posed by the instruments, which are in big demand among fast-moving institutional money managers. The way the strategists see it, the source of potential trouble centers on market makers, who take the other side of trades and must buy and sell stocks to keep a market-neutral stance. The fear is a self-reinforcing downward spiral that rocks the entire market, as it occurred in February 2018.

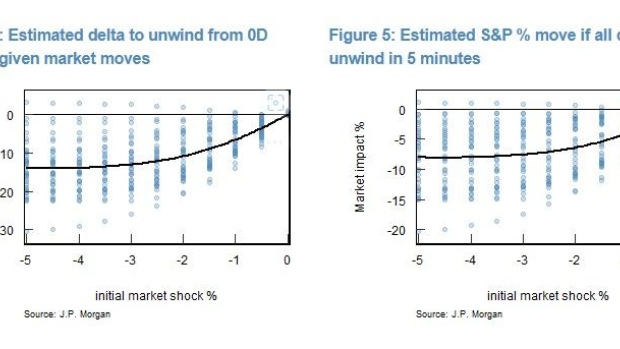

To measure the potential impact, the team employs a measure known as delta, or the theoretical value of stock required for market makers to hedge the directional exposure resulting from options transactions. To test an extreme scenario, they picked 1 p.m. as the time of the day for the study given it is the lowest point of the intraday liquidity during exchange hours, and focused on the market impact over a period of five minutes.

Tracking all option transaction in the first two months of 2023, Cheng tallied the net outstanding positions of all 0DTE contracts at 1 p.m. every day to derive at an average delta relative to market moves. Assume all outstanding zero-day contracts are unwound at the same time, a 1% decline in the S&P 500 could fuel delta selling of $6.6 billion, which corresponds to an extra loss of 4% during thin trading, their model shows.

In a scenario where the S&P 500 tumbles 5%, the average selling from options dealers could increase to $14.2 billion and drag the market down another 8%. In an extreme case, such a rout could lead to up to $30.5 billion of delta selling, or a hit of 20%.

To Brent Kochuba, founder of options specialist SpotGamma, the scenario analysis assumes a static market environment, whereas in reality the selling from options dealers would likely be countered by the covering of existing positions and potentially the addition of new ones.

“We’d anticipate that a large number of traders would rapidly adjust positions into a sharp decline,” said Kochuba.

Meanwhile the JPMorgan team also provided an estimate on retail’s participation in these high-octane products. Right now, only around 5% of S&P 500’s 0DTE options are initiated by day traders. That compared with roughly 20% for their share in similar contracts tracking the SPDR S&P 500 ETF Trust (ticker SPY).

“We do not observe a significant pickup in retail participation” since Cboe Global Markets Inc. first made daily options expiry available to investors last year, Cheng wrote. “Therefore, we do not believe retail investors are the main driver of the 0D option volume growth.”

©2023 Bloomberg L.P.