Jan 19, 2022

Junk Debt Is Poised for Worst Month Since the Early Days of the Pandemic

, Bloomberg News

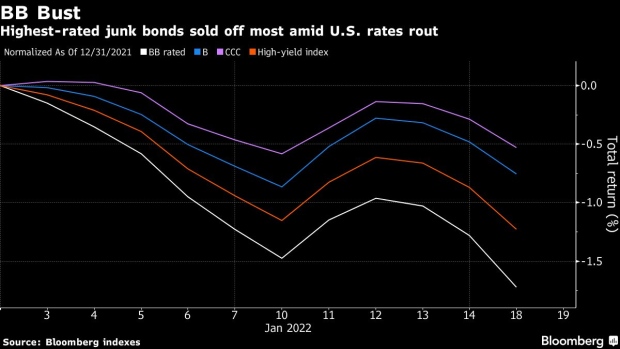

(Bloomberg) -- Rapidly rising yields have dragged junk bonds down by the most since the pandemic started, led by the highest-rated bonds, which face record losses.

The Bloomberg U.S. Corporate High Yield Bond Index is down 1.23% year-to-date, headed for its biggest monthly tumble since March 2020 and worst January performance in six years. About half that index is rated BB -- the rating tier with most duration, or sensitivity to rising rates -- and those bonds have fallen by 1.7%.

Read more: Markets Tremble at Fed’s Unprecedented Double-Edged Tightening

At this rate, BB debt will have the worst January on record, according to index data compiled by Bloomberg that goes back to 1983. The overall junk index is meanwhile having its rockiest first month since 2016.

“If we see some real spread widening while core rates continue to rise, high-yield investors will feel real pain,” said Christian Hoffmann, portfolio manager at Thornburg Investment Management.

Fund flows have turned negative as anxious retail investors dump riskier debt. The biggest ETF tracking junk bonds suffered the third-largest daily outflow in its 15-year history Tuesday.

To be sure, strong U.S. economic growth, robust company balance sheets and a lack of significant nearby debt maturities are seen supporting junk bonds. Default rates hit a record low 0.5% last year and are expected to rise only slightly to 1% this year, according to Fitch Ratings.

“From a spread perspective we are pretty positive, it’s really about the Fed and how aggressive are they going to get over the horizon, and any potential policy missteps,” said Matt Kennedy, a high-yield portfolio manager at Angel Oak Capital Advisors.

The worst-rated junk bonds are doing best, with CCC debt down 0.53%. That rating tier includes energy producers which have been supported by the rally in oil prices.

Elsewhere in credit markets:

Americas

Goldman Sachs Group Inc. and Morgan Stanley are the latest Wall Street banks to tap the U.S. investment-grade bond market after reporting fourth-quarter results.

- KKR Capital-led Addison Group’s $525 million first lien deal tightened pricing and changed its benchmark to SOFR from Libor

- It’s the first loan to do so midway through syndication since Heubach Group’s $610 million loan in October

- Multilateral institutions are raising debt in loonies at the fastest pace on record as Canadian-dollar borrowing costs are attractive once the proceeds are swapped into anchor currencies such U.S dollars

- For deal updates, click here for the New Issue Monitor

- For more, click here for the Credit Daybook Americas

EMEA

Europe’s primary market was busy again, with 17 issuers pricing 20 tranches for 20 billion-euros ($23 billion) equivalent.

- Austria priced a three-part euro-denominated bond deal, while Greece sold euro benchmark 10-year notes

- In high-yield, Swedish International Petroleum came to market for a $300 million five-year note

- As other parts of credit struggled, leveraged loan prices rose further in Europe this week, extending their month-to-date gain to 0.3%, the largest since February 2021

- In the CLO market, deal flow is slowly picking up with investment management firm Barings pricing a reset

- Floating-rate bank notes are giving dollar-bond investors something rare in 2022: positive returns, even if minuscule

- The securities that pay higher coupons when short-term U.S. interest rates rise have returned 0.06% so far this year, compared with a 2.3% loss for U.S. Treasuries and a 3.1% drop for U.S. high-grade corporate debt, Bloomberg indexes show

Asia

Chinese high-yield dollar bonds surged on Wednesday, with a number of developers’ notes on pace for record daily gains, after a report said that China is drafting eased rules for pre-sale funds in escrow accounts.

- Asian dollar-bond issuers continued to return to the primary market on Wednesday to secure funds before borrowing costs rise, with at least four borrowers including China Water Affairs Group Ltd. marketing debt

- Genting Hong Kong Ltd. has filed to wind up the company in one of the biggest stumbles by a cruise operator globally after the pandemic ravaged the industry

- Thai companies face greater challenges than peers in Southeast Asia from rising interest rates given a slower rebound in the tourism-dependent economy

©2022 Bloomberg L.P.