Dec 12, 2022

Korea Short-Term Debt Yields Fall for First Time Since 2021

, Bloomberg News

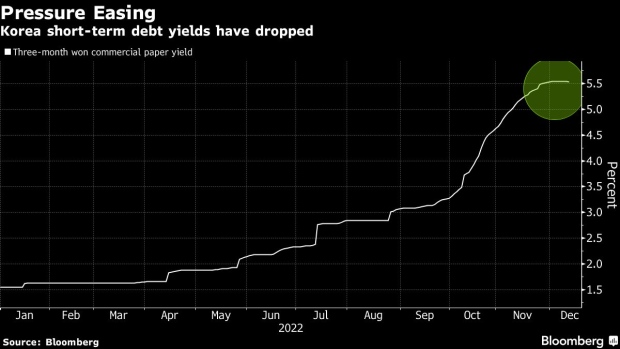

(Bloomberg) -- The strains in South Korea’s credit market showed further signs of easing, with short-term borrowing costs falling for the first time in 20 months on Monday.

Yields on three-month commercial paper — which companies use to raise funds for short-term payments like payroll — dropped a basis point in Seoul on Monday, which means conditions are improving. That would be the first decline since April 2021 after trading little changed last week, Bloomberg-compiled data show.

The drop underscores the easing of financial conditions underway after Korean officials in October rushed to ring-fence a full-blown crisis in what was considered one of Asia’s safer debt markets. The trouble began when the developer of an amusement park defaulted on a type of asset-backed security called PF-ABCP.

“The credit market has generally turned strong since early this month, and even in the CP market, which had shown relatively slow to recover, demand has recently been growing, mainly from high-quality issuers,” said SK Securities analyst Yun Won-tae. “Still, difficulties in PF-ABCP may continue for a while.”

Korea’s credit crunch highlights the tough balancing act officials around the world face as they seek to maintain both price and financial stability. Singapore’s central bank late last month warned of “potential dysfunction” in global funding markets and liquidity strains on financial firms that could spill over to banks and companies.

Click here for a timeline of Korea’s response to the credit crunch; here for a PF-ABCP explainer

The near-meltdown of Korea’s debt market started after the developer of the Legoland Korea theme park in Gangwon province defaulted on its debt in late September.

Yields on commercial paper then surged to their highest since 2009, as the missed payment spooked investors. Officials responded with a liquidity support package of at least 50 trillion won ($38 billion), by relaxing the collateral rules for transactions with the central bank, and with guarantees for real estate projects, among various measures.

In a sign of those steps bearing fruit, the spread on 3-year AA- corporate notes has begun narrowing. Investor appetite for new debt appears to be growing, with net issuance positive so far in December after two consecutive months of negative net sales, data from Korea Financial Investment Association show.

Also on Monday, Gangwon province made good on its pledge to repay the 205 billion won of debt the amusement park developer had defaulted on, Yonhap News reported, citing the municipality’s Governor Kim Jin-tae.

But with liquidity typically thin at the end of the year, there could be further bouts of volatility in the money market.

Stabilizing the commercial paper market would “take time,” Bank of Korea Governor Rhee Chang-yong told Bloomberg in an interview late last month. An improvement to conditions was likely in the new year when liquidity becomes more abundant.

In the interim, the BOK has pledged to provide additional liquidity.

--With assistance from Harry Suhartono and Jan Dahinten.

(Updates with detail, background from first paragraph)

©2022 Bloomberg L.P.