Mar 29, 2024

Korean Banks Say to Compensate Investors for China-Linked Notes

, Bloomberg News

(Bloomberg) -- Some South Korean banks agreed to compensate investors facing losses from structured products tied to Chinese stocks, just weeks after authorities said some of them misrepresented the complex instruments when making the sales.

Kookmin Bank and Shinhan Bank said Friday they both received board approval for the compensation guidelines proposed by the Financial Supervisory Service. The products in question are equity-linked securities tied to the Hang Seng China Enterprises Index.

The two lenders are the nation’s biggest sellers of the structured notes, which offer bond-like coupons if the underlying equities or indexes maintain certain levels. If they drop sharply, investors can lose much or all of their principal.

Standard Chartered Bank Korea, Citibank Korea and NongHyup Bank had accepted the FSS’ guidelines on Thursday.

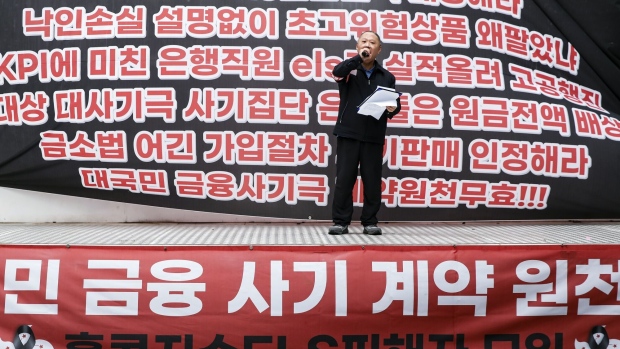

The moves come after a regulatory probe, which targeted major lenders and brokers including Kookmin Bank and Shinhan Bank, uncovered poor compliance and systematic failures over the sale of the exotic instruments to retail investors. The banks’ likely partial compensation plans, however, may meet fierce opposition from investors who want to be fully reimbursed for their losses.

According to the FSS guidelines, most ELS investors will be compensated for 20%-60% of their losses.

“Nobody would have bought this product if they had adequately explained its high risk,” said Ju Jae Hyeon, who lost 53% of his money from an ELS product he bought at Kookmin Bank. “It gives just 2%-4% interest but its downside risk is unlimited.”

Sold by Korean banks when Hong Kong shares peaked in early 2021, the structured notes are in the red as the HSCEI has since more than halved.

Hyosung Kwon, Bloomberg Economics’ Korea economist, estimated earlier this month that the cost of compensating retail investors may reach around 2.4 trillion won ($1.8 billion) for banks and around 0.4 trillion won for brokerages this year — assuming the HSCEI holds at its end-February level.

©2024 Bloomberg L.P.